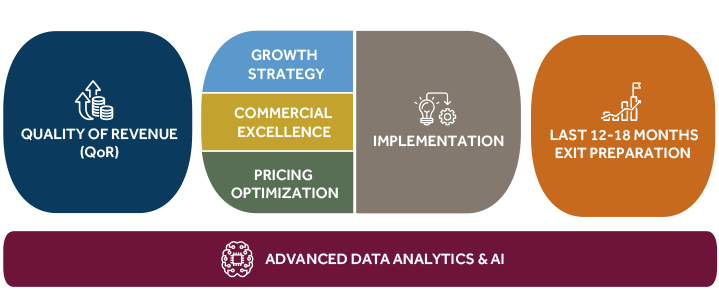

Revenue Growth Strategy

Using our proprietary methodologies, we help clients define their revenue growth strategy, including strategic actions and tactical improvements in execution.

- Adjacency Scans

- Market Assessment

- Competitor Position Analysis

- Internal Capability Assessment

- Opportunities to Play and Opportunities to Win

- Growth Plans Inside and Outside the Core

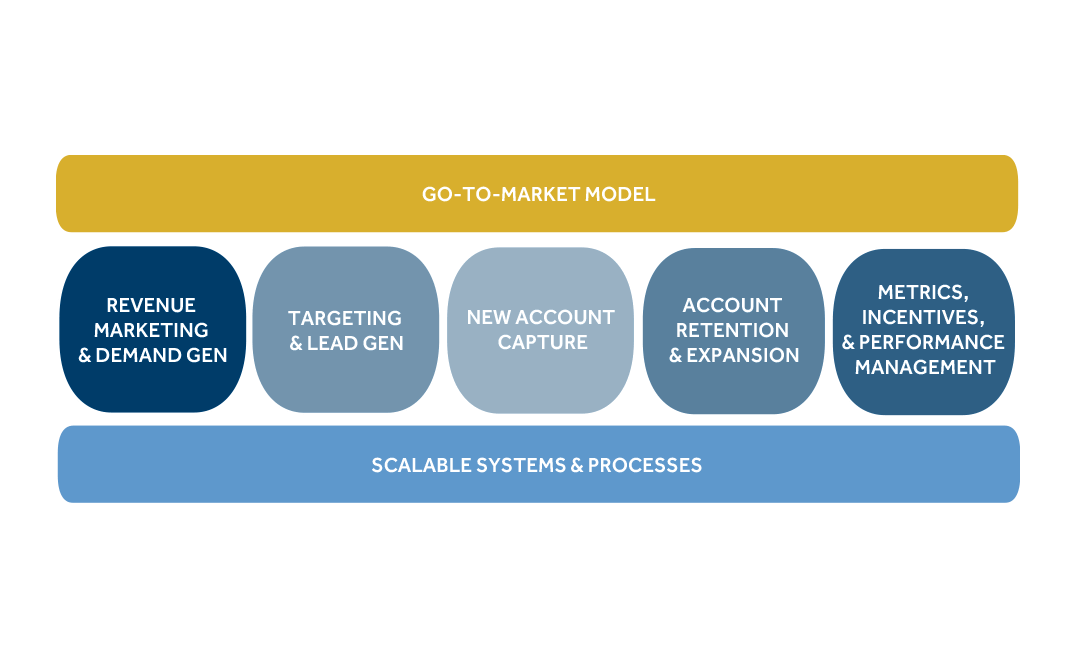

Commercial Effectiveness

Growth requires strong and reliable execution across an organization’s functions: sales, marketing, and customer service.

- Go-to-market model

- Talent, motivation, and culture

- Sales processes and tools

- Field marketing

- Sales enablement and operation

- Sales management

Pricing Optimization

Pricing is one of the most impactful profit levers a company can pull. Our clients often achieve 300 to 600 basis points or more of margin improvement.

Our pricing team tackles three key questions:

- How do you identify the right price?

- How do you ensure customers pay that price?

- How do you sustain and improve pricing performance?

Quality of Revenue (QoR) Diligence

Blue Ridge Partners offers Quality of Revenue Diligence, a fact-based forecast of a company’s revenue performance. QoR Diligence provides:

- Greater conviction in bidding

- Faster start to organic growth acceleration

- Mitigation of downside surprises

- Earlier successful exits

The most proactive and exit-focused PE firms prioritize growth early. They evaluate a target’s QoR alongside its QoE and market context.

Exit Planning

Preparing for a successful exit starts early and requires strategic focus. Our exit planning approach equips businesses with tools and insights to maximize value and align with buyer expectations:

- Quick wins to drive EBITDA improvements / multiple expansion

- Growth strategy

- Fact-based, market-focused growth story

- Shaping the business, as best able, to optimize value through a potential buyer’s lens

By taking a disciplined, buyer-focused approach, we help position your company for a high-value exit that captures its true potential.