Unlocking Value in the “Long Tail” of Smaller Customers – Leveraging the Power of AI and Cohort Clustering

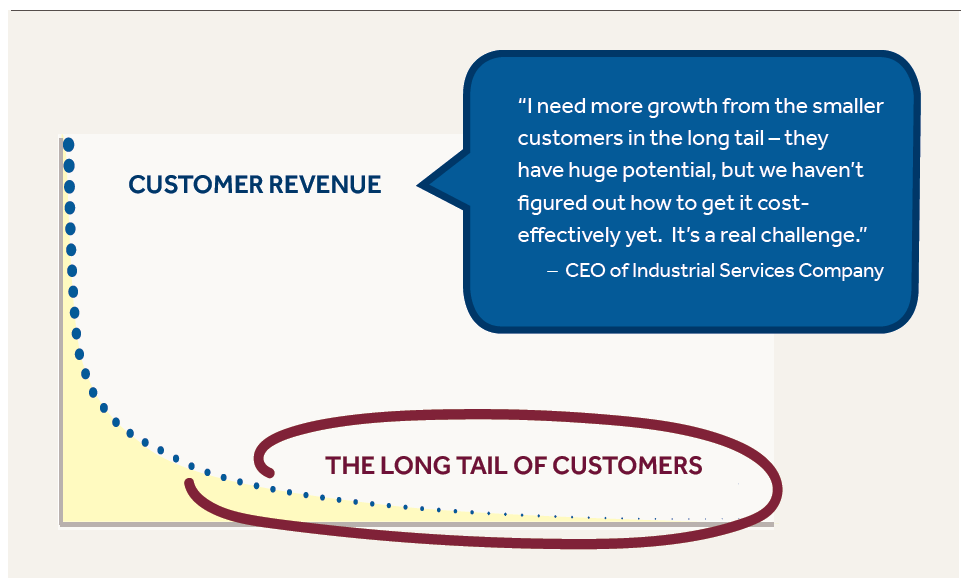

Maintaining strong relationships with larger customers remains a crucial mission for most companies — indeed it would be a mistake to overly focus on smaller customers. But the long tail of small customers can hold significant untapped revenue growth and margin expansion opportunities. While many executives have recognized the potential value in the long tail, the challenge has always been how to identify, prioritize, and capture that value at an acceptable cost.

Now with new data sources, advanced data analytics, and AI, the value of the long tail can be unlocked more effectively than ever before. The key is applying these emerging toolsets to develop practical micro-segmentation and cohort clustering to identify patterns in the long tail that can drive significant new revenue growth and improved margins. These new tools and techniques can be equally applied to the existing customer base and targeted small customers.

While focusing on costs is certainly a requirement, the inability to identify the most attractive subset of long tail customers to approach, as well as with what messages, product offers, and price points, can lead to disappointing results and a downward spiral of lower revenue, higher churn, and scaling back investments. Plus, there is a material risk of losing attractive but underserved

customers to competitors.

Understanding the Opportunity

Most often, we see companies taking an unfocused approach to managing long-tail customers, such as using customer service departments to deal with inbound orders, assigning an inside sales team or a channel partner to cover these accounts, or relying on self-service. Such undifferentiated treatment usually has the objective of minimizing the cost to serve rather than maximizing revenue and margin contribution, and often results in lower customer satisfaction. Underperformance in the long tail is not surprising given this approach, commonly resulting from the following:

- Lack of insight into what is important to these customers and what would motivate them to buy more in a way that is most effective for them

- Lack of simple ordering processes, like self service, that make it easy to buy

- Poorly designed inside sales coverage with ad hoc processes, inexperienced management, and misaligned skill sets

- Inflexible product bundling and pricing models that make it difficult for new accounts to buy and for smaller accounts to increase their spend

- Limited marketing support and ineffective targeting/messaging for key long tail “clusters” of segments

- Potential conflicts with other sales teams on what is in the long tail and what is not. For example, the midmarket sales team resists giving up customer prospects to the inside sales team or channel partners.

Overcoming the Challenge: Micro-Segmentation and Cohort Clustering

Many of the issues above relate to poor understanding of the long tail. Often, customers are lumped into a “small customer” or “SMB” segment based on historical spend, with few insights on the profiles of these customers (for example, we often see large global companies classified as SMB due to their small purchase volume to date!). The ‘secret sauce’ in determining how to make meaningful returns from the long tail of customers is using advanced data analytics and AI to develop the microsegmentation that reveals who they are, their business model, key personas, buying behaviors and timing, relevant messaging, product preferences, breakthrough offers, and preferred methods of contact. Here are examples of some cohorts we often find in the long tail:

- Customers who bought more in prior years and have declined significantly

- Customers with major potential but who buy alternatives or buy from competitors

- New customers with high growth potential

- Seasonal or periodic buyers

- Customers who would buy more if it was easier to buy – e.g., no frills products with lower price points, lower minimum purchase quantities, or self-service

- Customers exhibiting signs of potential attrition or stagnating growth

- Customers exhibiting signs of latent demand / growth potential

- Unprofitable customers with a high cost to serve relative to their lifetime revenue potential

- Customers who will never buy much due to their nature or loyalty to competitors

Historically, companies have been reluctant to make significant investments in the microsegmentation needed to gain this understanding, without any assurance that there will be meaningful revenue growth as a result. However, today’s technology can break through the clutter to uncover real insights into important customer cohorts in the long tail at a modest cost, helping better serve these customers and unlock their potential. Identifying the cohort clusters won’t fix underlying weaknesses in the servicing model, sales management, coverage, pricing models, etc., but it is a necessary first step in defining the opportunity and what is needed to capture it.

Cohort Clustering: Four Examples

- An equipment rental company identified a microsegment of customers needing pumps at the same time each year. They identified this as a cluster of golf courses (needing to winterize their sprinkler systems) and developed an attractive bundled offer to capture this demand, some of which would otherwise have gone to competitors. This approach helped expand existing accounts while adding new ones.

- A shareholder services company realized that there was a cluster of small customers at a certain stage of life that would likely trigger a major revenue generating event. By engaging with these customers proactively, our client was able to double their revenue in this micro-segment.

- A healthcare distribution company with over ~70,000 practitioners micro-segmented practitioners by patient volume, approach, tenure, growth velocity, and other factors and developed focused sales plays for each. They captured over $30M in additional revenue from a subset of 3,000 practitioners in the long tail.

- A software company learned that the specific mix of current and legacy products owned could indicate which specific customers would be most likely to buy additional products and which specific products. They very quickly identified $25M of new cross-sell pipeline.

How We Can Help

Blue Ridge Partners helps our clients simplify and accelerate the process of developing effective micro-segmentation by using AI techniques, a broader set of data sources, and cluster analysis to identify patterns of behavior, buyer preferences, relevant messaging, engagement pathways, and potential spend. This work can be completed in a two-week sprint that identifies key dynamics of the micro-segments of the long tail, including revenue potential, buying behavior, product usage, history, and potential value.

Our approach capitalizes on AI’s power to ingest and evaluate multiple levers simultaneously to find clusters of customers calling for differential action for each. Typically, we search for high value “lookalikes,” fading/churning customers, common buying patterns, potential self-servicers, and high potential but underserved customers. Unique clusters often emerge (sometimes using proxies for unavailable data) which are specific to a client’s unique characteristics. From these analyses, we can determine actions and associated costs to capture these hidden long tail opportunities. Once the long tail of customers has been analyzed and segmented, a customized sales and servicing model can be tailored for different cohorts, such as:

- Creating an inside sales motion for customers with sufficient upside potential, along with precision targeting, messaging, and tailored offers

- Establishing self-service, no-touch models or outsourced coverage for low potential accounts

- Providing Account Manager coverage for larger accounts with significant potential that have been buried in the long tail

- Developing focused sales plays for seasonal buyers to capture more of their spend

- Simplifying product/pricing and taking other actions to make it easier for smaller accounts to buy

This micro-segmentation of the long tail of customers and prospects allows companies to mine the value hidden in this often-overlooked set of customers. With these actionable, data-driven insights, companies can now cost effectively reach and sell into the long tail of customers at attractive margins, tapping into the significant value of these customers as never before.

Understanding which micro-segments are attractive and what messages are most appealing will help develop targeted programs that are far more cost effective than the broad-brush programs of the past. Relatively modest improvements can lead to significant increases in company revenue and EBITDA.

Questions to Determine Whether Long-Tail Analysis Makes Sense for Your Company

- Is revenue growth in the long tail segment lower than the rest of the business?

- Is the long tail of customers negatively impacting EBITDA margins?

- Does the current coverage model for long tail customers require too much management attention and cost?

- Is small customer churn at unacceptable levels?

- Does Customer Service struggle with providing timely response because they are consumed with servicing small customers?

- Are competitors successfully driving growth by serving small customers?

Getting Started

Blue Ridge Partners has worked with over 1,200 companies in the past 22 years and this experience allows us to assess the potential in your long tail of small customers in approximately two weeks. We will evaluate your current approach to selling and serving the long tail, identify improvement ideas, and size the prize. For further information, contact us at [email protected].