The Price Increase Window Remains Open for Software Companies In 2024

Results of software CXO survey from March 2024 indicate continued price increases

Summary

Driven by inflation, the price increases software companies introduced in 2022 and 2023 were far greater than the those of the prior ten years. However, many CXOs and private equity leaders we spoke to this year believed companies might struggle to implement meaningful price increases in 2024. Considering these trends, Blue Ridge Partners conducted a CXO survey to determine what software companies were really doing with their 2024 pricing.

Key Findings

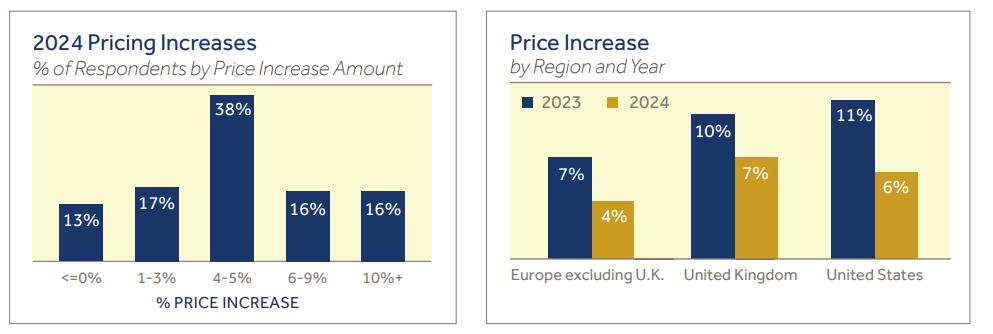

- Nearly 90% of software companies have raised or plan to raise prices in 2024, with an overall median increase of 5%. Average increases are higher in the U.S and U.K. at 6-7%, compared with 4% in continental Europe.

- 2024 price increases are 30-40% lower than the companies’ 2023 price increase.

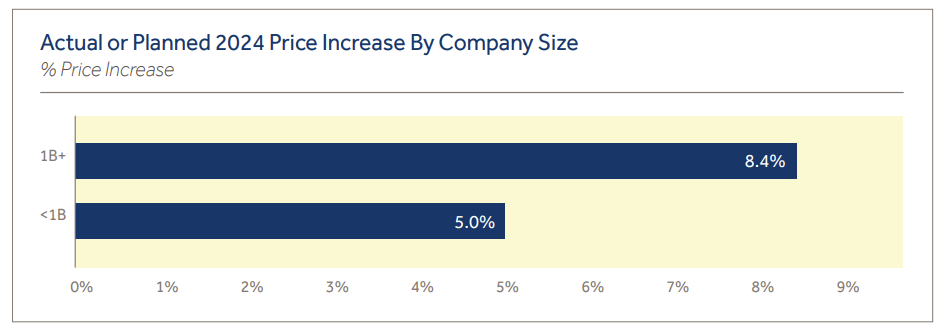

- Larger software companies continue to significantly outperform smaller companies in their ability to capture price increases, with 1B+ companies averaging 8.4% compared with 5.0% for those <1B.

About The Survey

In March 2024, Blue Ridge Partners completed a survey of 151 CEOs, CFOs, CROs and CMOs from software companies in North America and Europe varying in size from 100M to 5B* of ARR (Annual Recurring Revenue).

Price increases by level and across regions

2024 Price Increase by Software Company Size (ARR)

As we have previously reported, larger software companies continue to meaningfully outperform small and medium-sized companies in their ability to push and capture larger price increases. The primary reason for this is that larger companies have invested in internal pricing teams, tools and reporting capabilities, and more regularly perform buyer

research to understand the true value of their solutions.

Immediate Action Items

- Consider implementing 2024 price increases of at least 5% and probably 7-9% unless there are extenuating circumstances. This is particularly important for <1B companies.

- Perform fresh buyer research to align prices with fair market value and identify segments willing to pay higher prices (e.g., company size, use case, industry vertical, geography).

- Tighten discounting governance and report on net price achieved by commercial team and segment.

- Address common pricing opportunities such as raising prices in the long tail of small customers and ensuring that you capture the full value delivered to enterprise customers.