Strong Pricing Results Persisted for SaaS in 2024 with Further Upside Projected for FY25

2022-23 Gains Continue, with Further Upside Projected for FY2025 and Beyond

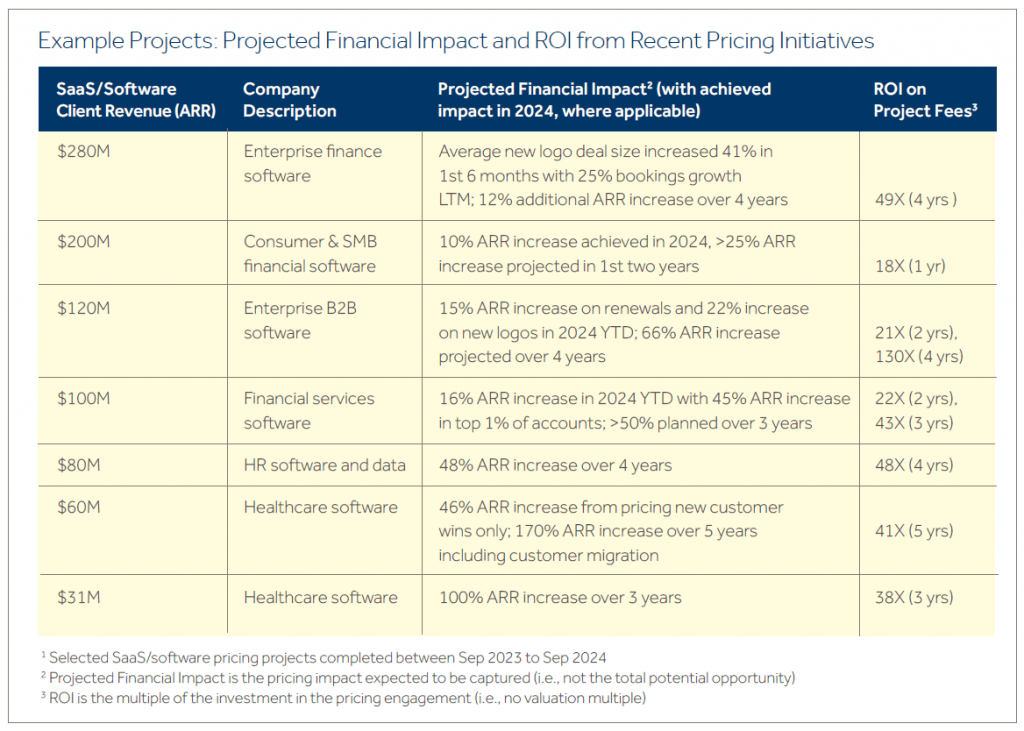

With inflation and other economic factors improving in 2024, many CXOs, PE deal teams and operating partners have had concerns that pricing impact may decline this year compared to prior years. Our data shows that pricing impact remains strong.

Pricing is arguably the #1 value creation lever, so having an accurate read on expected pricing upside is important for deal teams considering what to include in an investment thesis or to maximize value at exit, and for CXOs who are working on FY2025 planning and budgets. Results from our recent software company pricing engagements indicate financial impact matching 2022-2023 levels.

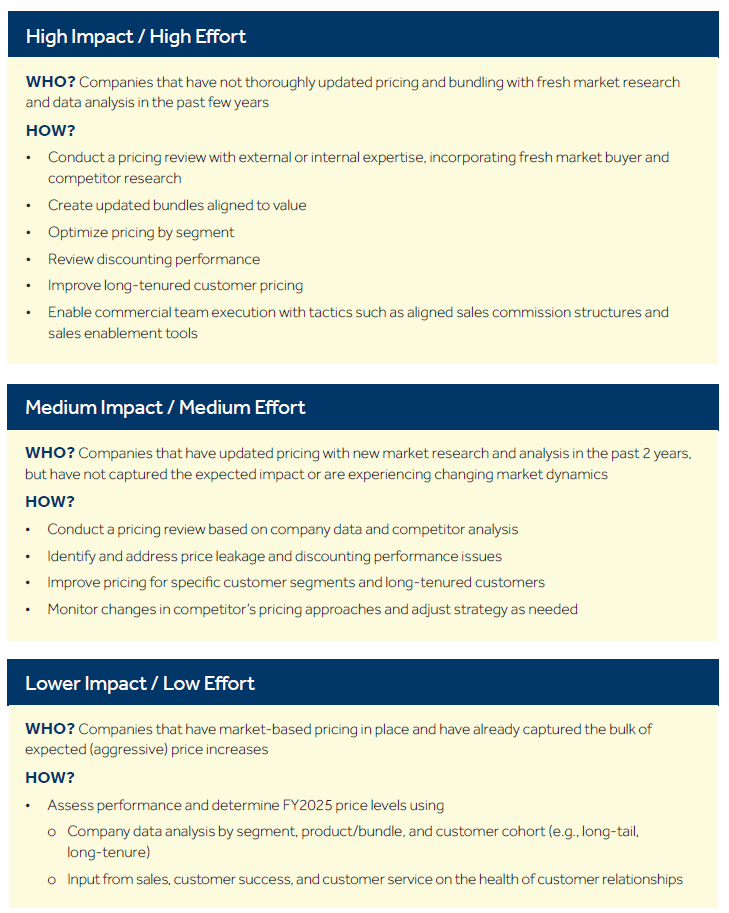

What price increase and FY2025 budget impact should be forecasted?

The answer primarily depends on a company’s recent pricing efforts, market position, and level of effort invested in leveraging pricing as a key driver of value creation:

Pricing remains a powerful lever for driving growth and maximizing value creation—especially in preparation for exit. For companies that haven’t yet taken a rigorous, market-informed approach to pricing, a substantial opportunity is still available. Leveraging robust competitor, customer, and buyer data, alongside internal analysis, can deliver substantial financial impact that persists over time.

At Blue Ridge Partners, we apply deep industry expertise and practical tools to create sustainable pricing strategies. Our experienced team brings a hands-on approach, aligning strategy with frontline execution to achieve lasting results that support growth and value creation.