SaaS CXOs now more optimistic about 2024 growth

Leveraging commercial model improvements and new products to drive growth

Summary

With meaningful changes to economic and political factors in early 2024 (largely occurring after 2024 plans were set), how have software CXOs’ perspectives on 2024 growth changed one quarter into the year? To find out, we recently completed a market survey to learn about CXOs’ changing growth expectations and the initiatives they are now prioritizing to drive growth.

Key Findings

- 7x more SaaS CXOs have increased economic optimism compared to 90 days ago, with the increase being “somewhat more optimistic”

- Software companies are now projecting an average of 15% revenue growth in 2024 with the fastest growing software companies projecting 40%+ growth

- 70% of software CEOs and CFOs believe their company’s sales effectiveness and commercial model improvement initiatives will be a primary driver of 2024 growth

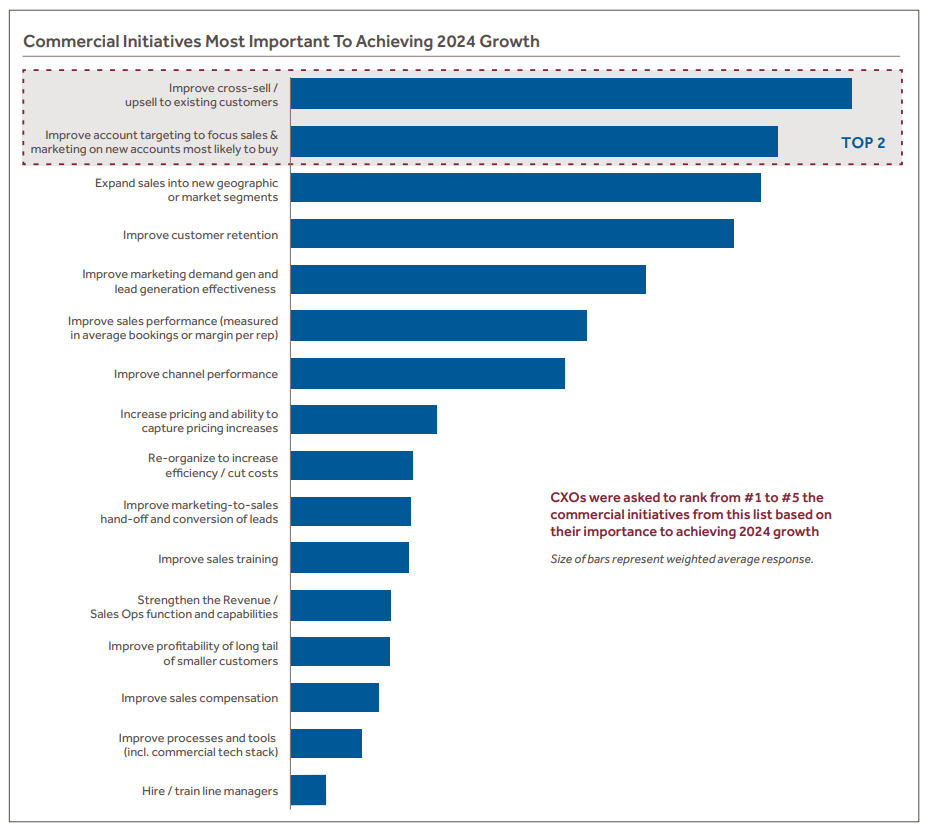

- Improving cross-sell/upsell to existing customers and improving account targeting for new account sales were viewed as the most

critical commercial initiatives to achieving 2024 growth - Nearly 90% of software companies have raised or plan to raise prices in 2024, with average increases in the U.S and U.K. at 6-7% compared with 4% in continental Europe. These increases are 30-40% lower than the companies’ 2023 price increase. For more insight into the pricing opportunity, click here to read our dedicated report on this finding.

- Few companies plan to make meaningful cost reductions in their

commercial organizations

About The Survey

In March 2024, Blue Ridge Partners completed a survey of 151 CEOs, CFOs, CROs and CMOs from software companies in North America and Europe varying in size from 100M to 5B* of ARR (Annual Recurring Revenue).

Increased economic optimism

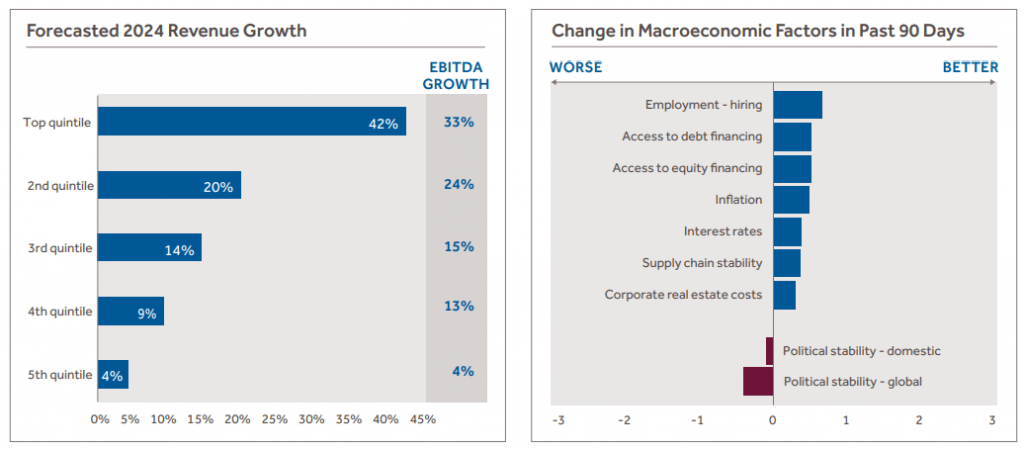

Software CXOs are somewhat more confident in the economy now than they were 90 days ago, with 62% of CXOs having increased economic optimism versus only 9% having a more negative view. While no dramatic changes in economic factors over the past 90 days were cited, hiring, financing and inflation were viewed as more favorable with political stability being viewed as less favorable.

The top quintile of software companies expected to grow by 42% in 2024, and there were only modest differences in growth expectations across North America and Europe.

Key initiatives to drive 2024 growth

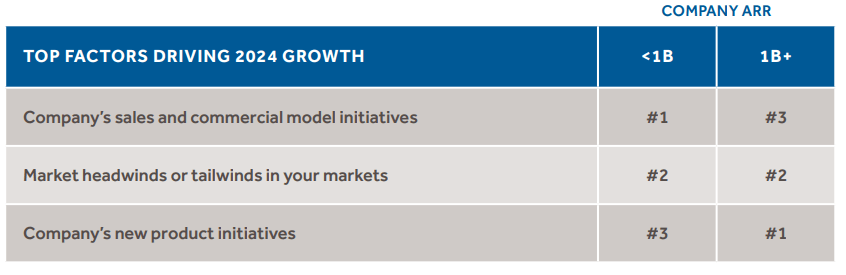

Software companies of all sizes cited three primary factors driving 2024 growth, with companies <1B indicating that commercial model initiatives were #1 and 1B+ companies leveraging new products as their top driver.

Within commercial model initiatives, the clear top priority was increasing cross-sell and upsell to existing customers.

Blue Ridge Partners has worked extensively in this area and found that there are 3 primary challenges to improving cross-sell/upsell performance:

- Organizational responsibilities – improving expansion revenue while minimizing the risk of distracting hunters from new business or overly relying on CSMs* with limited sales skills

- Account targeting – teams struggle to know which accounts to focus on without good white space analysis to understand the potential upside and predictive targeting to know the probability of success

- Product targeting and pricing – challenging to determine which products a particular customer is most likely to want next and what price is appropriate given their history

Increasing expansion revenue is a very solvable initiative, and in our experience, could generate an incremental 5-10% overall revenue growth for large and medium-sized software companies.

The #2 top initiative is improved account targeting on new accounts. In our experience, the best approach for this is leveraging new external data plus internal data to determine specific predictive attributes that indicate higher propensity to buy and higher lifetime revenue, to focus prospecting efforts. This can free up 20%+ of a sales team’s time spent on prospects not likely to buy, and reinvest that time on prospects with higher win rates and lifetime value. This typically results in a 10-15% increase in net new revenue.

We also asked CXOs about other key topics that are impacting their businesses early in 2024.

AI – sharply increasing investments but lacking clear strategy

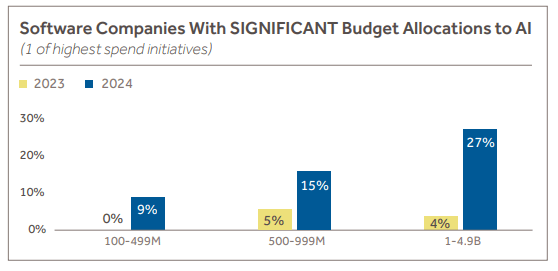

Software companies have significantly accelerated their investment in AI in 2024 versus 2023 with large software companies moving more aggressively into AI than small and mid-size companies.

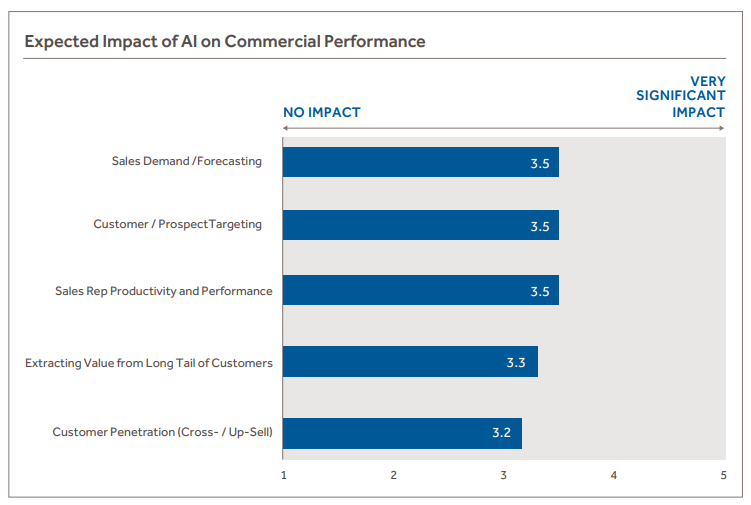

Despite increased investment in AI, software companies lack conviction around where AI will generate the most benefit to commercial

performance or how they will implement AI capabilities.

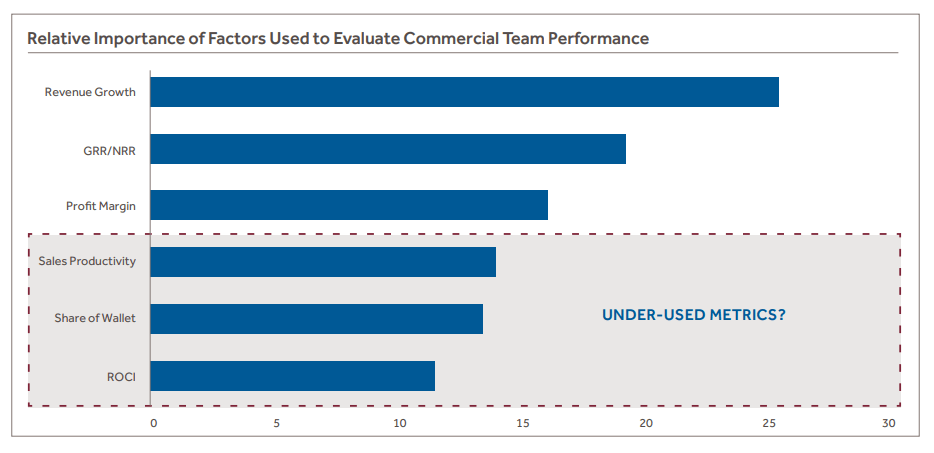

Is it time to update commercial team performance metrics?

Most software companies are evaluating commercial team performance based on traditional factors like revenue growth, renewal rate and profit margin. Is it time to update or add to these metrics? For example, are companies realizing an acceptable ROI from their commercial investments? Could the ROI be higher? Where should the next economic unit be invested?

We believe CEOs, CFOs and Boards should expect higher results from their commercial investments and should increase focus on sales productivity, share of wallet and Return on Commercial Investment (ROCI)* as key performance metrics.

“We spend more time analyzing the ROI on a $1M IT investment than we spend evaluating the $400M we spend in sales and marketing each year.

– CFO, Fortune 500 Company

Suggested Near-Term Actions

- Evaluate current commercial growth initiatives and consider re-prioritizing to include:

– Cross-sell/upsell initiative to generate more expansion revenue

– Account targeting initiative to improve sales productivity and accelerate revenue from new accounts - Rethink your commercial performance metrics, adding some that balance growth and ROI, such as sales productivity and Return on Commercial Investment (ROCI)