Survey Results: Rewriting the PE Value Creation Playbook for the 2024 Market Environment

Many market factors are forcing changes within the Value Creation Teams of private equity firms. In April 2024, we surveyed both operating partners and investment partners in Europe and North America regarding the challenges facing their portfolio companies and how these challenges are impacting the size, shape and structure of their Value Creation Teams. We received 66 survey responses with healthy representation from different roles, geographies and PE firm sizes.

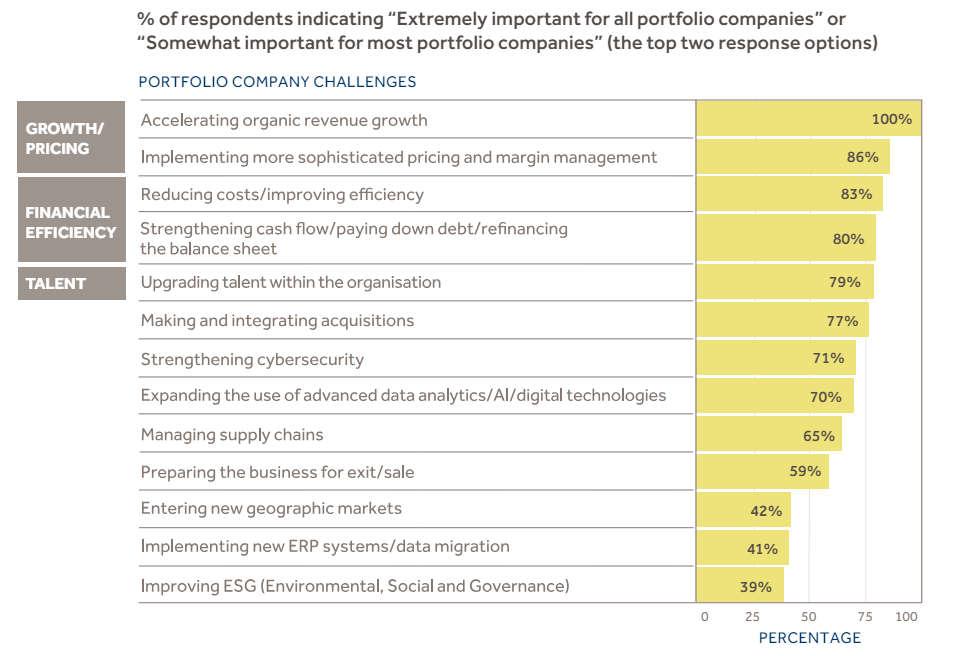

SURVEY RESPONSE: When we asked the survey respondents, “How important are each of these operating challenges over the next 12 months for the portfolio companies you serve most closely?”, they responded as follows:

The responses to this question became more interesting when we compared investment partners responses to operating partner responses. These two groups were reasonably in synch on the importance of…

- Accelerating organic revenue growth

- Implementing more sophisticated pricing and margin management

- Reducing costs/improving efficiency

- Making and integrating acquisitions

- Strengthening cybersecurity

- Expanding the use of advanced data analytics/AI/digital technology

- Implementing ERP systems/data migration

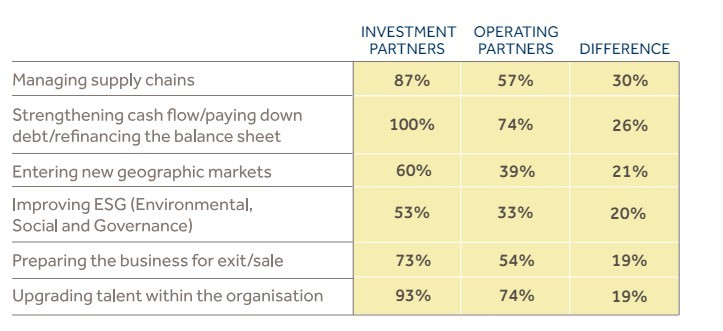

However, investment partners rated the following operating challenges as much more important than operating partners:

Interestingly, there wasn’t a single operating challenge that concerned operating partners more than investment partners.

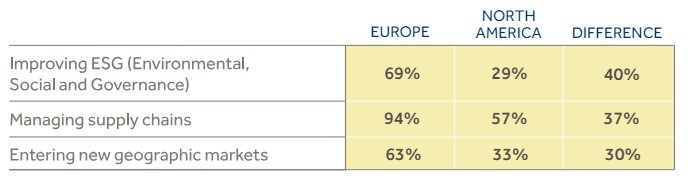

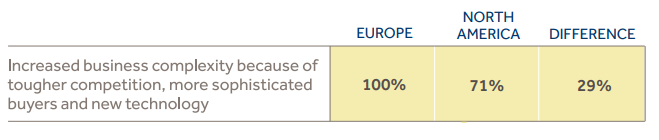

As described above, when we looked at the differences between European vs. North American responses, there were three material differences, all suggesting greater concern in Europe than North America:

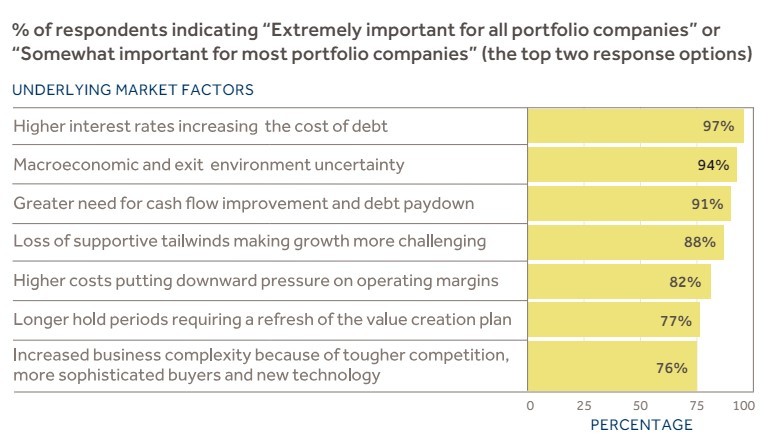

SURVEY RESPONSE: There are many underlying market factors pressuring management teams in 2024/2025. When we asked the respondents “How challenging will certain market factors be for your portfolio companies over the next 12 months?”, we received the following responses.

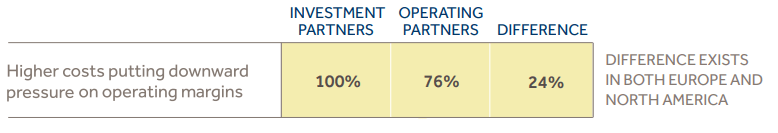

We found a high level of consistency between investment partners and operating partners regarding the market factors pressuring management teams. There was one significant exception to this…

There was one significant regional difference, suggesting a more complex environment in Europe than North America.

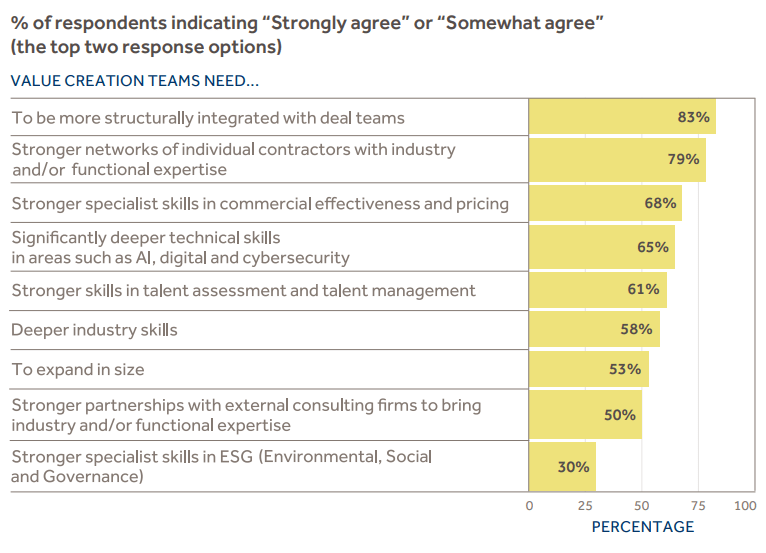

SURVEY RESPONSE: So, the question is “what does all this mean for the size, shape and structure of Value Creation Teams?” We asked survey respondents and here are their answers.

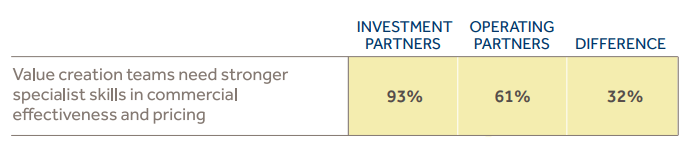

One might argue this was the most important question of the survey. There are important insights from the overall survey responses but interestingly, there was one significant difference in the responses between investment partners and operating partners.

One other material difference appeared in larger vs. smaller PE firms. Some people might expect that smaller firms with thinner internal resources need stronger partnerships with external consulting firms. However, funds over $1B expressed much greater need for stronger partnerships with external consulting firms to bring industry and/or functional expertise (averaged 63%) than smaller funds (averaged 24%).

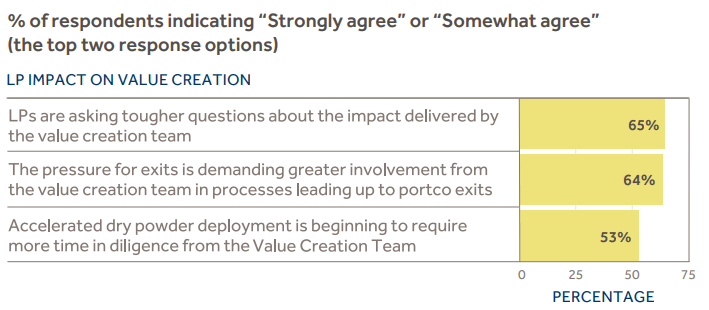

SURVEY RESPONSE: As one final thought, we asked survey respondents how LPs might be impacting the posture of Value Creation Teams. Are LPs applying pressure in some way that’s changing the internal dynamics of value creation efforts? Here are the survey responses:

There were no material differences in these responses between investment partners and operating partners or between Europe and North America. There was one noteworthy difference by industry. The pressure for exits is demanding greater involvement from the

Value Creation Team in Industrials (80%) and Business Services (77%) than the average of the other industries (56%).

The same two industries scored higher than average for “LPs are asking tougher questions about the impact delivered by the Value Creation Team” (75% for Industrials, 73% for Business Services and 59% average for other industries).

Larger funds more strongly agreed with the statement, “accelerated dry powder deployment is beginning to require more time in diligence from the Value Creation Team” (63% for funds larger than $1B versus 35% for funds smaller than $1B).