How To Budget For Your 2025 Price Increase

Results of software CXO survey from November 2024 reveal plans for continued pricing aggressiveness in the U.S. and U.K. with some softening in Europe

Summary

One big question most boards, CEOs and CFOs have on their minds as they set FY25 budgets is whether the company can expect continued strong pricing gains. For the 3rd year in a row, Blue Ridge Partners has surveyed software CXOs to answer this question and understand their current thinking about 2025 price increases.

About The Survey

In November 2024, Blue Ridge Partners completed a survey of 118 CEOs, CFOs, CROs and CMOs from software companies in the U.S., U.K. and Europe varying in size from 100M to 5B of ARR ($/ £/ €).

Key Findings

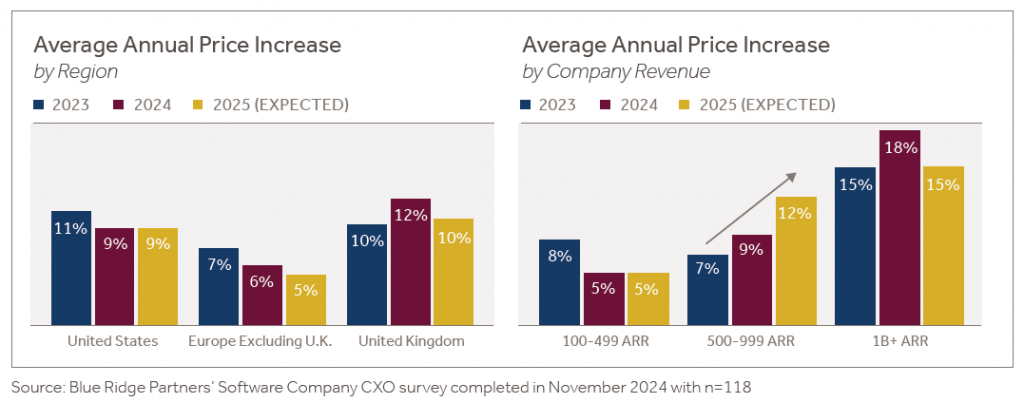

- Continued Aggressive Increases: U.S. and U.K. software companies expect continued aggressive pricing in 2025 with price increases averaging 9-10%, while European software companies averaged an expected 5% increase.

- Mid-Market Opportunity: Mid-sized companies (500M to 1B) globally, perhaps driven by private equity ownership, have become significantly more aggressive, with annual price increases growing from 7-9% in 2023 to 12% planned in 2025. Software companies <300M in ARR continue to miss the pricing opportunity due to lack of focus and prioritization.

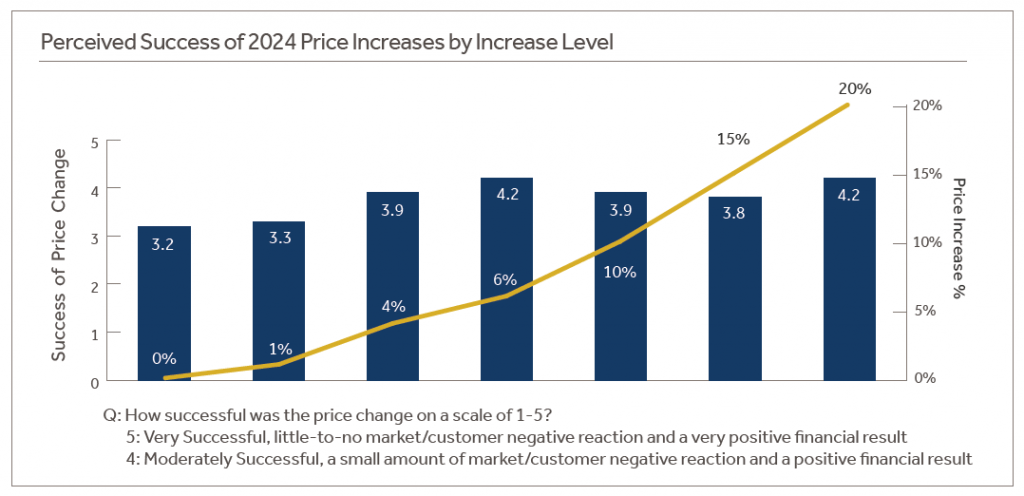

- Low Pushback on High Increases: Software companies who executed more aggressive price increases (15%+) in 2024 reported more pricing success than those with very small price increases, consistent with our 2022 findings that companies experienced minimal pushback from more aggressive price increases.

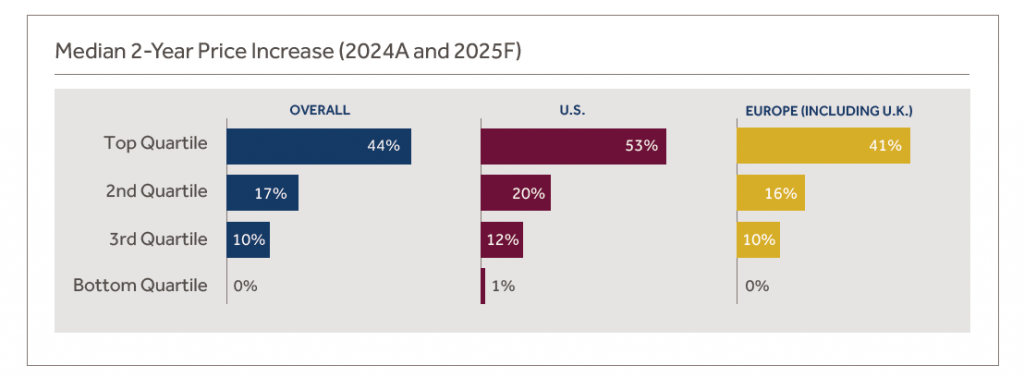

- Leading Companies Targeting Bold Pricing Gains: Top quartile software companies’ combined 2024-2025 price increases will raise their prices by 40-50% over those 2 years with 2nd quartile companies at a 16-20% increase.

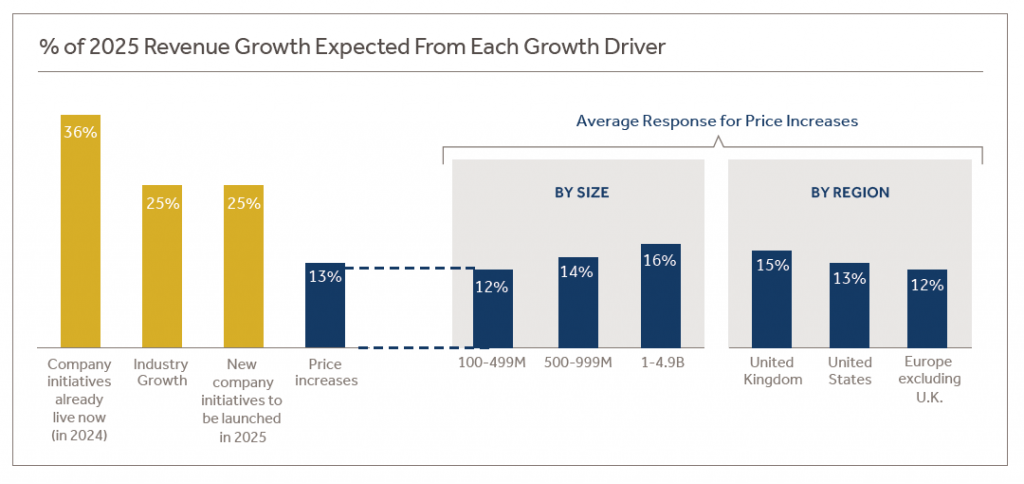

- Significant Growth Impact: Software companies expect pricing to deliver 13% of their overall revenue growth in 2025.

2024 Price Increases

Whereas in 2023, small and mid-size software companies both significantly underperformed $1B+ companies in pricing, in 2024 and 2025, mid-sized companies are increasing prices significantly (12%). They also appear to be increasingly committed to pricing best practices, with 80% conducting online pricing surveys and 93% fully reviewing and updating bundles in 2023 or 2024. Recently, we reported that results from 2024 pricing initiatives were every bit as strong as in 2022-23 for software companies.

There are many enemies of good pricing, and one of them is fear – fear that too large a price increase will cause excessive churn. Two years ago, our research showed that software companies who implemented larger price increases reported only marginally more market pushback than companies implementing small price increases. Our new research shows that this remains true: more aggressive pricing does not generally result in significantly more market pushback.

What Good Pricing Performance Looks Like

A more complete view of pricing performance should consider increases over a 2–year period to help answer the question of whether a company is getting ahead or falling behind the industry. When 2024 increases and planned 2025 increases are considered together, there is an even more dramatic difference between top quartile performers and other companies.

Impact of Pricing on 2025 Forecasted Growth

Across all software companies surveyed, the 2025 price increase is expected to generate 13% of the overall revenue growth of the company.

5 Steps to Increase Pricing Impact in 2025

To maximize 2025’s pricing potential, software companies need a strategic approach that aligns pricing with market demands. These five steps will help ensure your pricing drives meaningful revenue growth while minimizing risks.

- Set price increases towards the upper range of what is being considered for 2025, and tailor pricing to different market segments

- Launch a pricing optimization project with fresh online survey data and updated bundles if these have not been done in the past 2 years

- Report on pricing execution to the executive team monthly and board quarterly

- Tighten discounting guidelines and governance

- Assign Revenue Operations the task of improving pricing data capture and reporting in CRM and financial systems

Implementing these steps will empower your organization to capture greater value and continued growth in a competitive market.