How To Budget for Your 2024 Price Increase

An approach for estimating the budget impact of your likely 2024 pricing changes

Summary

We are about to complete another year of high inflation during which most companies increased prices far more than prior years. But with inflation cooling a bit and 2024 planning now in high gear how should companies forecast revenue and margin increases from their likely 2024 pricing actions? In this article we provide a price increase estimation approach based on our experience helping clients set and get their price increases over the past few years as well as multiple pricing research efforts conducted during this same period.

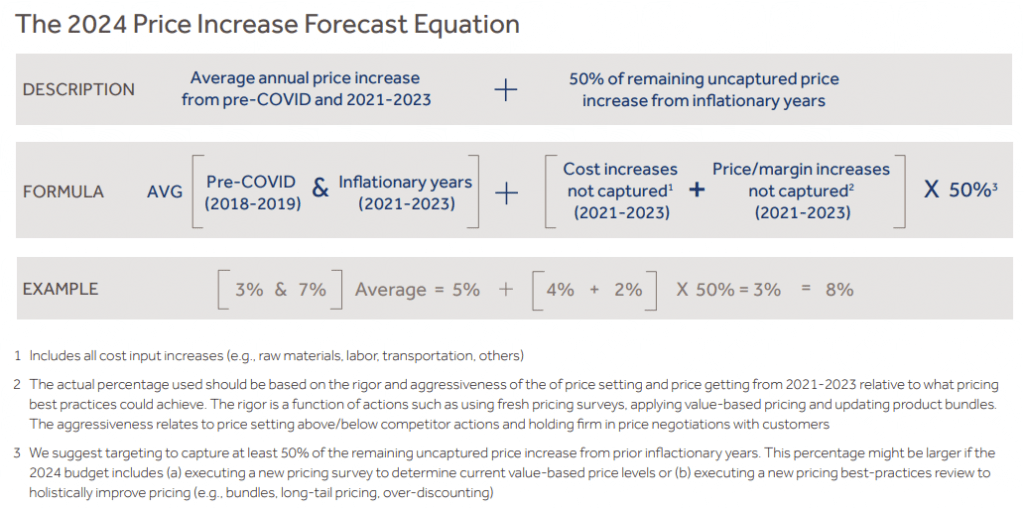

The 2024 price increase should be the sum of two components:

- Base increase – which will generally be a smaller increase than the past three years but larger than pre-COVID norms

- Price increase potential that remains uncaptured from recent inflationary years – For most companies, there is additional price increase potential by incorporating what was left

uncaptured from the prior high-inflation years

Base price increases in 2024 will generally be lower than 2021-23 but higher than pre-COVID norms

It appears that inflation and other market factors will not be as impactful on pricing in 2024 as they were during the last three years. However, we expect them to remain a bigger impact on prices than before COVID. Therefore, expect a higher 2024 base price increase than historic norms but not as high as the past three years. For industries with high labor cost exposure, it is important to budget for planned labor cost increases as part of price/margin setting.

Plan to capture additional pricing upside in 2024 that was not captured in 2021-2023

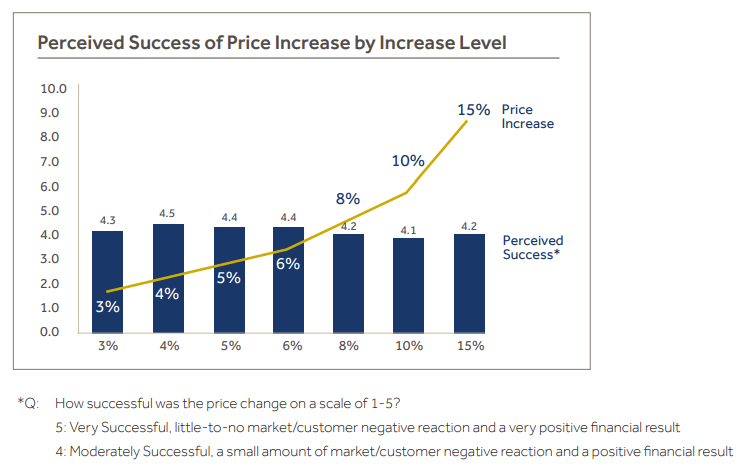

Although most companies increased prices during the inflation-fueled recent years, the reality is that most did not capture as much as they could have. Our research found that many companies stopped short of capturing their full pricing potential, but companies who pushed harder did not experience any greater negative pushback from customers. The chart below shows that in early 2022, companies that implemented high price increases – as much as 15% or more – faced almost no greater customer pushback than companies with smaller increases.

As one example of the potential price impact that was achieved in 2021-2023, we analyzed software companies with less than $300M of revenue who had completed a comprehensive price improvement program. We found that the average net revenue increase was 24%. Their price improvement program included higher standard pricing aligned to buyer’s current perception of value, higher pricing in some segments versus others, new higher-value bundles with higher prices, reduced discounting and other factors beyond just a price increase.

Unfortunately, many other companies stopped short of this complete set of actions and therefore left money on the table which can still be captured in 2024. Also, in our recent work with industrial, distribution and manufacturing firms, we found that while many firms did a good job of passing through raw material cost increases, most did not capture all cost increases, such as labor and transportation cost increases. As a result, these companies fell behind inflation.

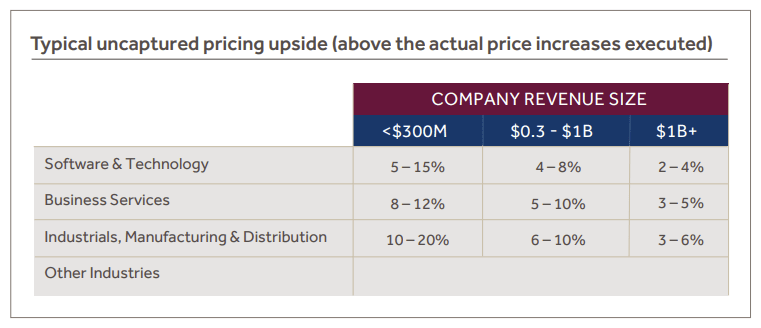

The actual “uncaptured 2021-2023 pricing upside” will differ for each company based on the rigor and aggressiveness of their 2021, 2022 and 2023 price increases. A reasonable estimate of the uncaptured upside is shown below, although this will vary by industry subsector and company.

To determine about how much potential pricing impact went uncaptured during the past few years, you should consider these questions:

- Was your 2021-2023 price increase % equal to or higher than competitors? Was your annual price increase roughly double the historic increase rate?

- Did you protect or expand margins relative to pre-COVID (e.g., factoring in variable input costs and fixed costs)?

- Did you raise prices even higher in some segments or for some products/services more than others? Across the board pricing increases are likely suboptimal.

- Did you close pricing leakages like underpricing the long-tail or too much discounting?

- Did you get fresh market data to set prices to current market value?

- Did you measure how much of your planned price increases were actually captured?

The more ‘no’ answers to these questions suggest that a greater upside remains to be captured in 2024.

Immediate Action Items

- Confirm and analyze the actual price increase % for each year back to 2018, as suggested in this article

- Meet with the pricing team to discuss the following:

- Review the pricing actions taken over the past three inflationary years

- Discuss questions A-F above

- Estimate the remaining uncaptured potential price impact from the past 2-3 years

- Discuss potential pricing actions for 2024

- Determine if fresh pricing survey data and/or a holistic price improvement effort should be under-taken during 2024

- Develop budgets for both the projected 2024 pricing impact (how much of a price increase and how much of that will be captured) and research expenses required to develop 2024 pricing