Go-to-Market Transformation Making Organizational Change Stick

Many companies have established robust commercial organizations, yet a significant number of them lack growth momentum, face declining margins, or both. These companies operate on autopilot, executing against “business as usual” and missing opportunities to apply better commercial practices that have been adopted by leading growth companies. The problem often stems from the market environment in which they operate. Some industries are seeing sluggish demand growth and companies use M&A to avoid addressing lagging organic growth. These companies win a certain percentage of their market year after year but are unable to accelerate growth by winning a greater share of wallets among their current customers or by adding new customers.

Industry consolidation offers some promise of change with larger groups adopting more commercially astute sales approaches vs their smaller peers. Interventionist private equity owners can be a force for change, with their portfolio companies adopting a sharper commercial toolkit. However, there remains a significant opportunity for a majority of companies to accelerate top-line growth by fine-tuning their go-to-market model, boosting discipline around their sales process, and adopting sales effectiveness tools. Companies across most industries are leaving money on the table by not optimizing their commercial models to drive organic growth. This presents a significant opportunity. Companies that transform the way they organize and execute within their commercial organization have an opportunity to accelerate profitable growth and enhance their margins.

CEO views on commercial transformation

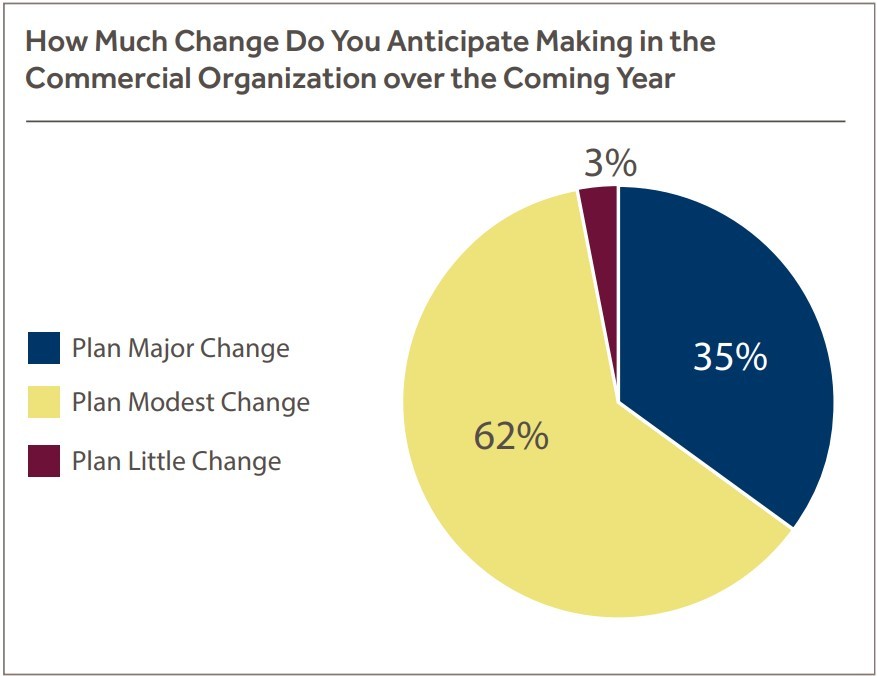

In 2019, Blue Ridge Partners conducted a survey of 37 CEOs regarding their views on go-to-market transformations in the coming 12 months. While every company sits in a unique position and therefore CEOs don’t have a common view on this topic, there were three main areas of agreement among them:

- Go-to-Market Transformations are high up on the CEO agenda, with more than a third (35%) of CEOs planning major changes to their commercial organizations in the next 12 months, and a further 62% planning minor changes, leaving just 3% comfortable with their commercial organizations as-is.

- These transformations are important despite year-over-year progress being made, with more than two-thirds (68%) reporting that they had gained confidence in their commercial organizations over the previous year.

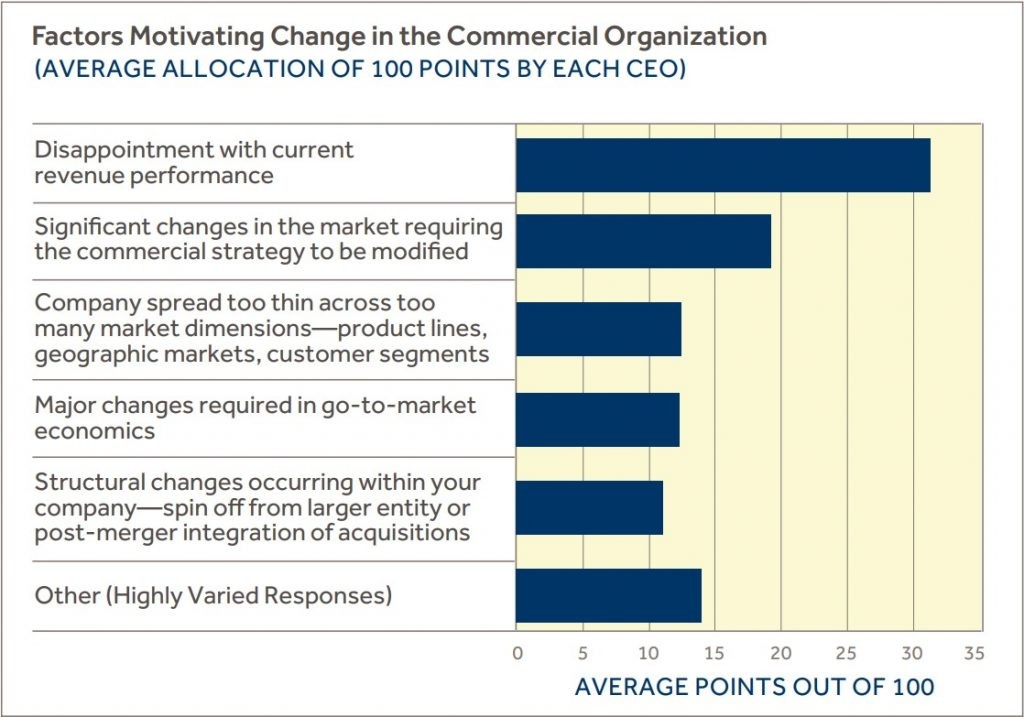

- The main motivations for CEOs to drive change in their commercial organizations are disappointed with their current revenue performance and changes in the market that require a change to the commercial strategy.

These insights demonstrate that while CEOs are keenly focused on this mission-critical function, and have seen positive results from existing improvement efforts, it has not been enough to meet their companies’ revenue goals or adequately adapt to dynamic market conditions. Clearly, a new approach to commercial transformation is needed.

Go-to-Market Transformation in Three Stages

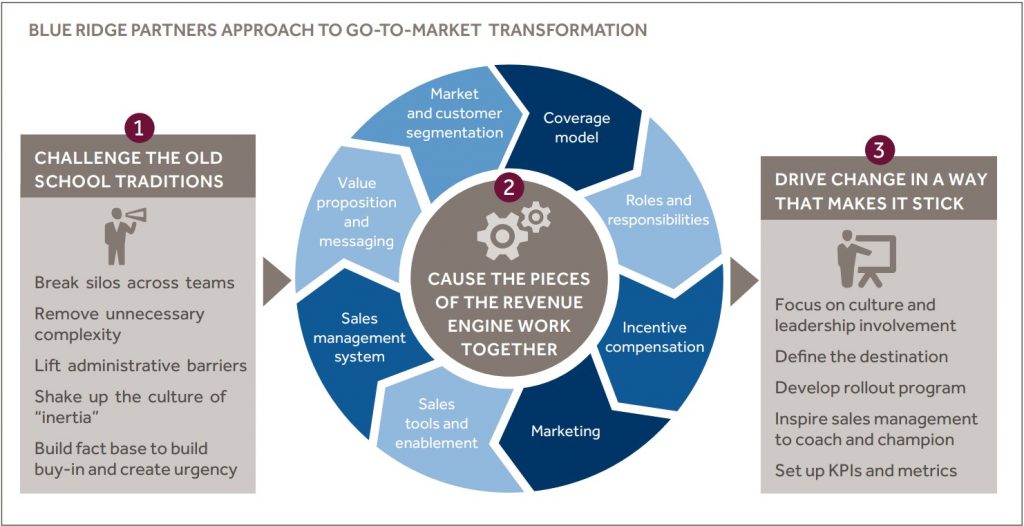

Blue Ridge Partners has worked with more than 600 companies across Europe, North America, and beyond, helping them address commercial challenges and accelerate top-line growth. Based on what we’ve seen, we have developed a three-stage process that is highly effective in helping companies transform their commercial organization and grow revenues:

Stage 1: Challenge the old school traditions. Identify and lift internal barriers and organizational complexity that are hampering effective selling.

Stage 2: Cause the pieces of the revenue engine to work together. Review key elements of the commercial model and cause them to act more effectively, and with more intent, against growth opportunities.

Stage 3: Drive change in a way that makes it stick. Drive sustained growth by maintaining momentum beyond the initial uplift from implemented changes. This might require changing the culture, setting up KPIs, instituting a coaching-focused sales management function, and introducing new tools needed to sell effectively.

Stage 1: Challenge the Old School Traditions

Companies often have established commercial norms and processes that have not changed for years. Many companies have regional sales teams with limited experience outside their industry and little exposure to better sales practices, resulting in people simply not knowing what “good” looks like. Additionally, basic tools to instill consistent sales approaches such as Sales Playbooks are often absent. As a result, they unwittingly create barriers to their own growth. Companies often get to this point unnoticed. Requirements are added to the sales organization and process layer upon layer until a degree of complexity has been reached that poses real challenges.

Here are some common internal barriers we have seen and recommend tackling first:

- Organizational silos. M&A activity can result in poor sales force integration, limited cross-training, duplication of work, and multiple cultures living alongside each other, often not collaboratively. Silos between local and national key account teams, and between sales and operations, are also common inhibitors among many companies.

- Organizational complexity. Often companies create organizational structures which produce inherent conflicts leaving money on the table; for example, two sales reps calling on the same customer or sales reps “driving past” customer prospects within ill-defined territories. We often see significant inconsistency across locations and sales rep performance. In businesses with a large and dispersed footprint, we have seen sales reps “going native”, where customer focus is to the exclusion of finding new opportunities for growth among current or new relationships.

- Administrative burdens. Excessive use of paper-based processes, burdensome approvals, inefficient quoting and delivery processes, and limited or inefficient use of digital tools (ERPs, CRM, lead generation, marketing tools, pricing tools, etc.) all lead to low levels of responsiveness to customers and good customer service dies ‘by a thousand papercuts’. Compliance intentions are often healthy, but these processes can become burdensome over time when they go unchecked.

- Culture of inertia. We have often seen organizations that show a widespread lack of entrepreneurial spirit and have become content with “business as usual”. The sales teams in these organizations have a mindset toward order-taking as opposed to proactive selling.

Addressing these barriers is the first step in transforming commercial organizations. Even very small actions, such as reducing redundant steps in a quotation process can result in “quick wins” towards Go-to-Market Transformation. We have seen the lifting of barriers has a profound effect on the motivation of local sales teams, leaving them feeling more empowered. Senior leadership’s open and candid acknowledgment of the administrative barriers – coupled with a transparent plan to fix them and the communication of achievements – generates initial trust and buy-in among customer-facing teams.

Stage 2: Cause the pieces of the revenue engine to work together

Many companies have several components of their revenue engine functioning well but lack alignment between them; they don’t work in sync. This is a problem because alignment can often be the key to the success of a go-to-market strategy. For example, if prospects in a certain size bracket are considered top growth targets, sales reps should have growth in this segment as a priority which is supported by marketing and recognized in their incentive compensation plan. This alignment is often lacking.

While the exact growth levers will differ for every business, here are some of the levers we have seen addressed most frequently among our clients:

- Market and customer segmentation. Many companies fall into the trap of believing they fully know their market and the needs of their customers. When existing customers and incoming orders keep the sales teams busy, it becomes tempting to ignore non-customers or less familiar segments and miss important new players. For sales reps, focusing not just on what they sell to customers but also on what they don’t sell and who they don’t sell, can break “comfort zone” habits and show significant untapped opportunity. Customer segmentation based on opportunity and evaluation of customer lifetime values is a well- a known tool that is not used enough by many companies. For example, a company may assume that the most headroom lies within local customer locations and thus miss large regional facilities that offer significant revenue opportunities with higher margins and less competition. Similar “blind spots” often occur with specific products, solutions, and industry segments.

- Coverage model. Many companies assign their sales resources to territories based on past customer sales results or legacy structures. Conducting a detailed market sizing study with estimated opportunity by a company is often eye-opening. It gives managers crucial evidence to focus the sales teams on the largest and most relevant opportunities rather than just looking back. For example, one experienced manager at a European industrial group was shocked to see his existing customer base covered only 20% of the market opportunity in the territory with some of the biggest potential targets being literally next door and never called upon. The company estimated the unaddressed market opportunity worth more than €1 billion in just one key market – a critical step in getting its salespeople to stop calling solely on the same people at the same customers.

- Value proposition and messaging. Many companies often underestimate the importance of value messaging and fall into the trap of transactional sales. Clearly articulating the right value message aligned to the right customer buyer values can be an important differentiator. Understanding the broader needs of customers in different segments is the foundation for developing effective value propositions and capturing premium pricing opportunities. Once developed, it is important to document value messages in the form of scripts and templates for training salespeople to use them. At one engineering parts company, the internal sales team was challenged by the low availability of rare stock items and often had to tell customers, “We don’t have this item in stock; it will take four weeks to deliver”. We asked this sales team to experiment with new phrasing around straightforward “value messaging pillars”, saying instead: “We can arrange to get this item for you. When are you installing it?” It turned out that most customers did not need the item urgently and could wait the four weeks. The company now reserves available stock for only urgent needs, enabling it to meet the timelines of both buying situations and raising customer perceptions of the business’s ability to meet their needs.

- Roles and responsibilities. Many companies have multiple sales and operational roles, including external sales, internal sales, branch managers, local managers, regional managers, delivery managers, and service managers. It is not uncommon to see these roles vary across regions and parts of a company. At the same time, duplication and lack of clarity between roles often prevent people from performing effectively. We have seen situations where sales reps’ own assessment of their “Skill and Will” levels are vastly higher than the assessment by their managers, suggesting a poor understanding of “what good looks like”. We have also seen reps go well beyond their roles to the exclusion of selling; for example, reps doing deliveries or following up on customer service issues instead of visiting new prospects. Consistent role descriptions, RACI matrices, and best practices packaged in the form of Sales Playbooks by role are very effective tools.

- Sales management system. “Sales management trumps sales reps”. In other words, a high-performing sales management layer is far more powerful than solely focusing on helping individual sales reps improve their productivity. Effective sales managers are the key to sustaining high performance over time and sustaining momentum after an initial sales effectiveness uplift. We have often seen sales managers not spend enough time coaching, and have conflicting interests between meeting their own sales quota and coaching—we have even seen sales managers competing with their own team members for deals, thus undermining team results. By getting sales managers focused on coaching with a regular cadence of one-to-ones, ride-alongs, and sales team meetings, sales managers and their teams learn and develop selling skills. Sales managers should spend at least 60% of their time coaching their reps, but our experience has found the percentage of coaching time is usually far less.

- Incentive compensation. Aligning incentive compensation with the business objectives is one of the most important drivers of commercial effectiveness. However, most incentive compensation schemes fail to incentivize the right behaviors and drive the results that leadership wants to see. For example, one company’s objective was profitable growth, but its incentive compensation focused only on gross margins of pre-assigned accounts. This resulted in high margins but declining sales and gave salespeople no incentive to go out and find new business. By changing the plan to focus on gross profit growth and putting in place accelerators to reward high performance, the company aligned incentives with the core business objective. At another company that had successfully transitioned from a perpetual license model to a SaaS subscription model, the incentive compensation plan structure had to change from a focus on new logo sales to renewals to drive growth.

- Sales tools and enablement. While most companies have ERP and CRM systems in place, these tools are often outdated or their use of them is irregular and inconsistent. Implementing simple and effective tools to track customer insights and customer interactions is critical, but sales forces often don’t believe that the tools will actually help them. To address this challenge, one company that was transforming its CRM system to adapt to a new sales model involved field sales from the outset in the design process rather than allowing an IT-led process. The company got feedback from its sales teams, incorporated that feedback into the system, created buy-in, and trained local champions who helped drive adoption and usage of the system.

- Marketing. Even a modest increase in investment in tailored marketing materials and campaigns can help materially differentiate companies in a competitive environment. When one company realized it had lost market share in its signature service area, marketers created a campaign and called on all their down-trading customers to ask when they were going to order next. This marketing effort gave sales reps a good reason to reconnect with customers and resulted in material new sales growth.

Stage 3: Drive Change in a Way that Makes it Stick

When transforming commercial organizations, we find that pilots are very useful for testing and refining the elements and – more importantly – for getting feedback from the teams and building their trust and buy-in. Once pilots are completed, it becomes very important to consistently execute and maintain momentum. There are five key elements to the effective execution of sales transformation programs:

- Culture and leadership involvement. Culture is key to making changes stick. However, it is very hard to change the culture. Through our work with a variety of businesses in Europe and the U.S., we have identified three types of activities that generate high levels of trust from teams and thus contribute to a cultural shift. All of these elements are related to leadership behaviors, as we’ve found that leadership starts the cultural transformation:

1) Leadership “walking the talk”. This includes setting a clear growth strategy, defining the destination, effectively communicating the strategy to local teams, and communicating personalized examples of changes required from each team member (“what does it mean for me”?). In one company, the leaders committed to a “top-to-top” meeting with each of its top 100 customers and made some quick decisions to show commitment.

2) Transparency and commitment. Leadership shows transparency in decisions and personal commitment to helping the company address barriers to growth. Acknowledging existing administrative barriers and silos, discussed in Stage 1, is an important step that generates trust and buy-in from local teams. An open style of communicating the rationale for major changes (e.g., compensation, organization structure changes) is another way to develop trust that teams highly appreciate.

3) Presence in the organization. A leadership presence across the organization – for Q&A sessions, to address concerns, explain the changes and plans, etc. – is crucial. When leadership participates in town hall meetings and customer calls, it can generate a lot of positive buzzes and positive energy across the organization. - Define the destination. A clearly defined point of arrival is often critical to the impact of any change program. Commercial teams are frequently pulled into different directions, especially in a period of turmoil, and a clear understanding of the journey helps create focus among key stakeholders and teams. Effective transformations often benefit from working back from this point of arrival in defining the transitional organization design and interim tools.

- Sales management. The success of any transformation depends on buy-in and adoption by sales management. When sales management kick-starts the transformation and sets the pace, we typically see a successful outcome; without their involvement, it is hard to achieve the scale of change required. Briefings and training sessions with the sales managers, train-the-trainer programs, and appointing local champions are all important steps to making sure the high-level strategy is effectively executed locally. One company experienced good results when it trained its sales managers to communicate the strategy and resulting changes. At their annual sales conference, sales managers presented the new commercial approach to their teams, which gave sales teams assurance that their managers were on board. It also gave team members an opportunity to ask questions and address concerns.

- Roll-out tools. Companies often have broad networks of relatively independent local sales teams, which can complicate the effective rollout of tools. One way to address this challenge is with rollout kits. We helped one industrial services group create rollout toolkits with sales effectiveness tools tailored to each local operation, including target customer lists with market-driven estimates of potential opportunity, value messaging and strategy templates aligned to their territories, incentive compensation calculators, and a set of Playbooks for both sales managers and reps. Creating a schedule of regional, and local rollouts involving management and led by sales managers is key to supporting the cultural element of the rollout.

- KPIs and measurement. Culture, which is arguably the most important element of a successful transformation, is hard to measure. However, introducing a clear set of relevant KPIs for each location, region, and role helps drive people in the same direction and holds them accountable. Location- or region-level visual dashboards with key metrics (such as location-specific sales growth, sales growth per customer segment, number of new logos, lines and locations, etc.) that everyone in a location can see gets everyone onto the same page and pointed in the same direction. One company that did this also introduced contests to become the highest-achieving salesperson and brought in bells to celebrate new customer wins. These celebrations, calling out team-based targets and winners, created a culture of entrepreneurship and boosted energy levels and focus.

Delivering results

Blue Ridge Partners has seen this approach to Go-to-Market Transformation work many times. Take the example of a European services group: the company was facing declining sales, high employee turnover, siloed legacy sales teams, and an uninspiring culture with significant administrative burdens. Some poor decisions were made by the former leadership team, resulting in the company being forced to downsize at an alarming rate. Long-standing relationships with buyers began to suffer.

We assisted this organization through the three-step process described above. After piloting changes at a sub-set of the company’s local teams, tracking results, and making adjustments, we rolled out the model to the rest of the network. As a result of the transformation effort, the company has reversed its sales decline and reignited its revenue growth, and is now achieving positive growth momentum. It has deepened existing customer relationships and developed new ones. Above all, a top-down change in a culture created a more entrepreneurial and empowered organization that is able to continuously deliver on growth opportunities. This is not isolated but is representative of a broader set of engagements across many industries both in Europe and in the U.S.