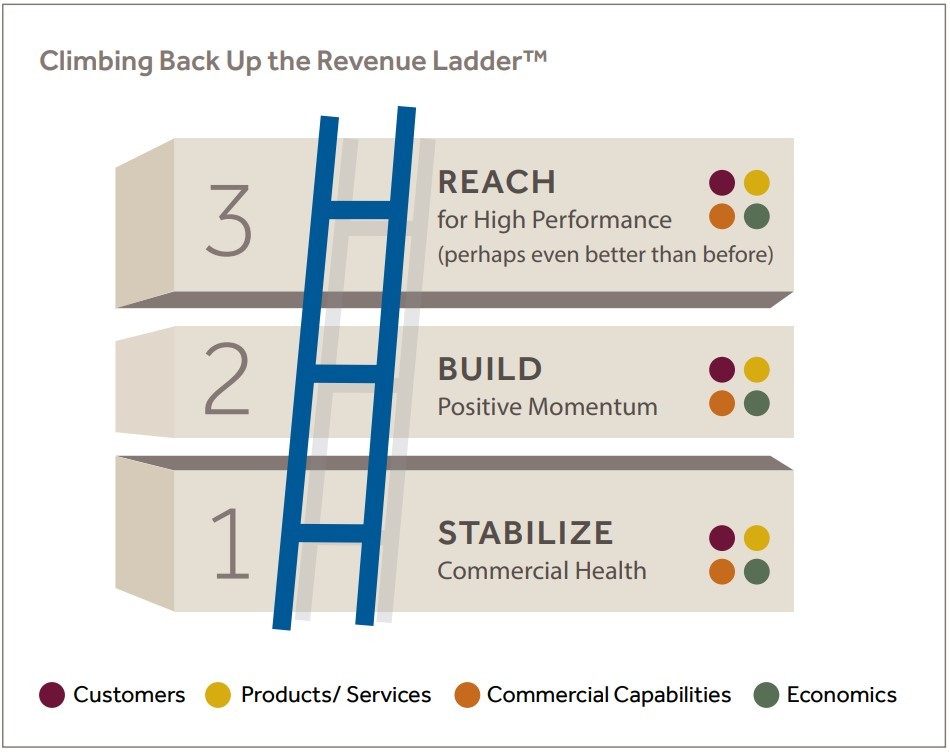

Climbing Back Up the Revenue Ladder™

Many companies in the US and Europe expect material revenue declines during 2020 due to the economic disruptions of COVID-19. The average revenue decline is expected to be 12%, according to a recent survey of CEOs and Chief Revenue Officers conducted by Blue Ridge Partners.

The appropriate first reaction to the pandemic by surveyed companies was to focus on employee safety, cash preservation, and cost reduction. With most of those immediate steps now taken, the question becomes, “How do we get our revenue back?” Many of these companies find themselves in deep revenue holes and must now consider revenue recovery plans, aimed at returning to their pre-COVID revenue levels and resuming growth from there.

The key, however, isn’t just a plan—it’s building new muscles. Commercial organizations will be required to do many things differently during the next 6-18 months to get their revenue back.

- More customer-centric in selling — providing stronger and more differentiated selling messages that resonate with the new world needs of customers and prospects

- More productive — embracing and incorporating virtual selling techniques and spending more time selling

- More disciplined — being more thoughtful about where sellers spend their time and how they qualify leads

- More analytic — applying science and analytics to prospecting, cross-selling, and pipeline management

- More cost-effective — making greater use of profit attribution models and ROI tools to ensure the commercial organization is cost-effective

“Getting your revenue back” is critically important for both private equity sponsors, whose value creation plans and timely exits depend on making this happen, and for corporations in their mission to enhance shareholder value.

Easier Said Than Done

It will be difficult for companies to climb out of a deep revenue hole, particularly in a short timeframe. Many of these companies were growing in the mid-single digits annually prior to COVID-19. Using these historical growth rates, it will likely take them two years to grow revenue by 12% (the average forecasted revenue decline for 2020). What would need to occur for revenue growth to suddenly accelerate? A “V-shaped” recovery would help, but a complete snap-back seems unlikely for many companies.

So, this becomes an issue of time. Can commercial leaders do anything to accelerate their revenue recovery? Is the only plan to wait and ride the wave of the overall economic turnaround? This is too passive to serve as a viable plan for investors. The real question is what proactive steps might commercial leaders take to accelerate their revenue growth?

For most commercial organizations, this is not about trying harder. There are too many new market realities that need to be accepted. For example, some customers and prospects are not going to be growing very fast and will be less attractive targets than they were prior to COVID-19. As one CEO described it, “We need to figure out which customers will be the winners in their markets and focus our selling efforts on them.”

Another example of the new market realities is the requirement for virtual selling. Not only will sellers be limited in their ability/willingness to travel, but customers are going to be less available for in-person meetings. Customers working in office environments are going to be difficult to visit. Building managers expect to lock conference rooms to avoid close contact. They might require half the occupants to work on odd days and the other half to work on even days, and visitors likely will be discouraged to minimize the number of occupants in the building. Assuming these circumstances continue for many months or years, how does a seller engage with customers and prospects? It will need to be done virtually. This requires new selling methods and tools along with new ways of supervising and coaching sellers for success in this new environment.

Dealing with these new realities might be a challenge for some commercial leaders. Most sales leaders are good at working ‘in the business but are not as good at working ‘on the business.’ Commercial leaders are very busy (and very skilled) at closing deals and working the system to optimize revenue for a month or quarter – in other words, working during normal times. Not all commercial leaders are effective at analyzing the changes in their markets and figuring out how to adjust their selling model in ways that will accelerate the revenue come-back.

Building a Revenue Recovery Plan (and New Muscles)

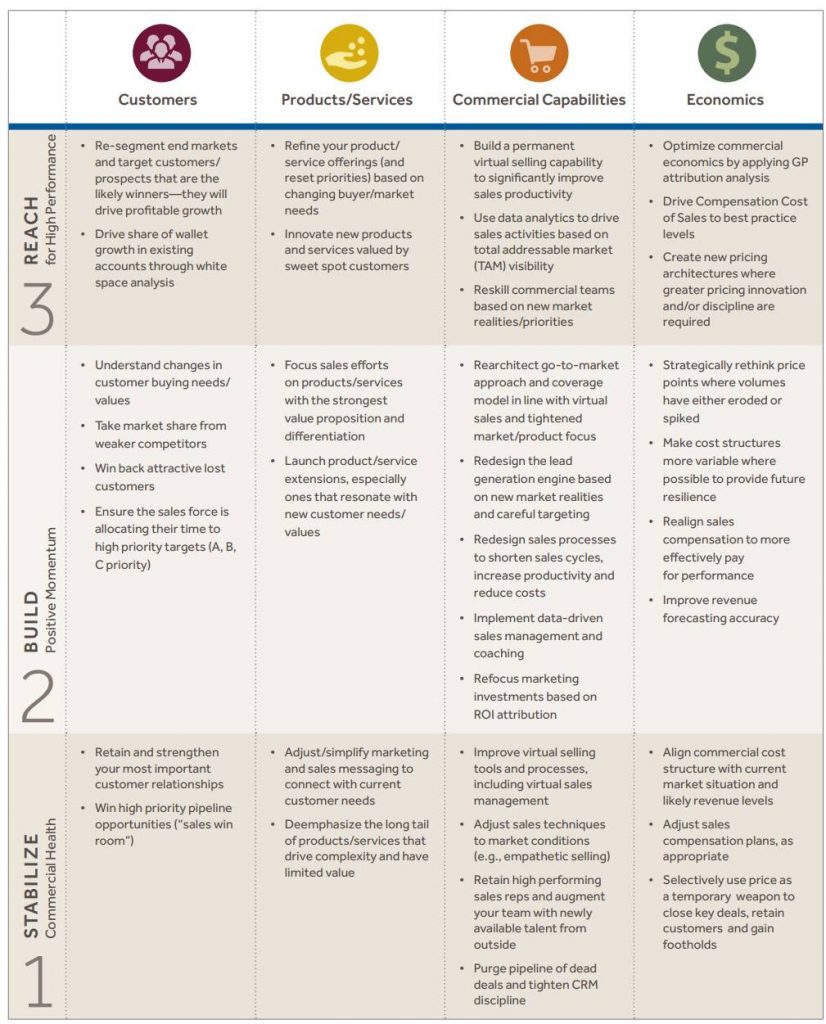

Based on hundreds of discussions with companies beginning the journey back to pre-COVID revenue levels and beyond, we have prepared a revenue-recovery framework for Climbing Back Up the Revenue Ladder™. That framework includes three sequential steps or rungs:

- Rung #1—Stabilize the commercial health of the business

- Rung #2—Build positive momentum

- Rung #3—Reach for high performance (perhaps even better than before COVID-19)

Most companies are hard at work on Rung #1. They are focused on retaining their best customers, learning how to manage sellers who can’t travel, cutting commercial costs when they must, and adjusting sales compensation plans to keep sales reps retained and properly motivated. Some companies have already stepped up to Rung #2, and a smaller number are on Rung #3.

On each rung, companies must address issues related to four distinct topics:

- Customers/prospects

- Products/services

- Commercial Capabilities

- Economics

Use the Climbing Back Up the Revenue Ladder™ framework (see next page) as a checklist or guide for considering actions that will help in revenue recovery and to see where you may The challenge is not simply Climbing Back Up the Revenue Ladder™, but making it a swift climb. A quicker climb gets you closer to your original value creation trajectory and keeps you ahead of competitors. Companies that don’t climb quickly will find their faster-climbing competitors beat them to the top and expand their market share.

An Example Revenue Recovery Plan with a New Set of Muscles

While each company’s journey through the Climbing Back Up the Revenue Ladder™ framework will be unique, here is an example of a revenue recovery plan for one $500m business services company operating in the US.

Revenue Recovery Plan

Rung #1—Stabilize the commercial health of the business

To stop the revenue slide and get onto a solid footing, the business services company did six things.

- Trained all its sellers on the use of remote selling tools including video conferencing, screen sharing, and webinars. The key training need was teaching the sellers to be more engaging in a video call (voice intonation, engaging slides, more questions.) It also trained sales managers on how to manage remote sellers.

- Reached out to all its most important customers and is staying in close communication with them to ensure awareness of these customers’ issues throughout the pandemic.

- Created a “sales win room” (a war room approach) to ensure that the commercial team and senior management focus on closing the most important opportunities in the pipeline. These big deals are getting spotlight treatment to maximize win rates.

- Sharpened sales messages to emphasize the benefits of its service offerings that relate to cost reduction and productivity improvement (attractive value propositions to its customers). The company also updated its collateral materials and sales talking points.

- Adjusted its highly variable seller compensation plan. To motivate reps, the company is giving 1.5x the revenue credit toward quota achievement for the next four months.

- Tightened the approval processes for price discounts and standardized its messaging related to customer requests for delayed payment terms.

| 1. NEW MUSCLES: STABILIZE |

| • Remote/virtual selling skills • Remote management of sellers and virtual coaching (no “ride-alongs” are happening) • Empathetic selling—listening to customers and caring about their situation • Sales war room skills to optimize win rates of opportunities in the pipeline • Sharper messaging for COVID-relevant buyer values |

Rung #2—Build positive momentum

Once commercial health was stabilized, the business services company sought to drive forward momentum through six initiatives:

- Virtual selling model. With revenue declining by about 15%, the company sought to lower its cost structure across the business, including in the commercial organization. Local markets that were low-performing before COVID-19 now require significantly lower selling costs to make these markets economically viable. To achieve this, the company institutionalized a virtual selling model for 50% of its business. The model includes new role profiles and hiring/ onboarding practices that will lower costs and improve seller productivity.

- A larger span of control. The supervisory ratio of sales managers expanded from 1:3 to 1:8, reducing the cost of sales management.

- Better targeting. The company is targeting prospects that are performing well in the current market, including healthcare companies, food manufacturers, and consumer products companies.

- More hands-on management. Commercial leadership has become much more rigorous in managing seller activities. They have shifted from a seller-driven sales model to a company-driven model. Sales managers are working more closely with each seller to reach the A-priority targets in their market, to qualify leads so unproductive proposal time is minimized, and to optimize the time spent selling. Pre-COVID, sellers spent just 30% of their time selling; they are now targeting 60% for the rest of this year.

- Increased accountability. With forecast accuracy critically important for this company right now, leaders are holding each sales manager accountable for their revenue forecast accuracy. Historically, revenue forecasting accuracy was very poor, driven largely by unwarranted optimism about closing probability and timing.

- Improved pricing. The company is raising price points on highly demanded services and lowering price points on others.

| 2. NEW MUSCLES: BUILD |

| • Restructuring the go-to-market model to reduce cost and improve sales productivity by permanently implementing virtual selling and a broader sales supervisory structure • Sharper customer segmentation and targeting • New playbooks for both sellers and supervisors • New sales supervisory cadence (daily sales huddles, weekly 1:1 pipeline reviews) • More accurate sales forecasting and monitoring the accuracy of forecasts by sales managers |

Rung #3—Reach for high performance (perhaps even better than before COVID-19)

With an eye to a stronger future, the business services company is counting on four initiatives to bring it back to pre-COVID revenue levels and higher:

- It plans to build two new analytic tools – one to help with lead generation (total addressable market analysis to target new prospects) and a second to perform white space analysis aimed at finding cross-selling opportunities.

- A new virtual selling model will improve coverage in key markets, and a new targeting/ lead generation process is needed to maximize effectiveness.

- The company will roll out a new service offering related to managing safe and healthy office environments, as well as other service bundles suited to the virtual sales model.

- It is designing a new pricing architecture that will be based on usage rather than annual service agreements, an attractive value proposition for its customers right now.

| 3. NEW MUSCLES: REACH |

| • Deeper analysis of the total addressable market (TAM) by the named prospect • White space analysis to target and prioritize cross-selling opportunities • More customer-attractive pricing strategies |

Summary

Many companies are facing a challenge in quickly returning to their pre-COVID revenue levels. For most, it will not be an easy climb. They should consider planning their actions in three progressive steps—stabilize, build positive momentum and reach for high performance. But recovery will require more than a plan—it will require new muscles that have not been routinely exercised by commercial organizations. Companies will need to be more customer-centric, more productive, more disciplined, more analytic, and more cost-effective.

This is a tipping point for many commercial organizations. The “old school” way of selling is changing in response to new buyer preferences and behaviors. The next generation of sales organizations will apply more science to the art and will be managed more tightly based on company-directed priorities and processes. The result will be more cost-effective and more productive commercial organizations that are better aligned with the engagement preferences of customers.