Channel Partners: Accelerating Growth Through Managed Services

Channel partners of technology vendors face significant challenges with the acceleration of cloud adoption. Customers are becoming less captive, putting pressure on value-added reseller (VAR) revenues and margins. At the same time, the market is moving from products to solutions, forcing VARs to re-invent their offerings and provide effective “Day 2” Managed Services support. To retain traction in their end-markets and continue to offer value to vendors, today’s VARs are grappling with three pivotal questions:

- What does the evolving Managed Services landscape look like?

- How do I determine where to focus to accelerate the growth of managed services?

- How do I execute the move to Managed Services?

We have helped more than 400 companies accelerate profitable revenue growth, our sole focus. Our industry-recognized, battle-tested tools and methodologies enable clients to implement change effectively and successfully, leading to higher revenues.

Blue Ridge Partners

Our work across the technology value chain—with vendors, channel partners, service providers, and customers—has given us new insights into these questions and into the challenges faced by channel partners. The importance of addressing these questions cannot be understated.

VARs must deal proactively with the changes in end markets to deliver continued growth. At the same time, understanding the perspectives and strategies of vendors is critical for channel partners to remain relevant in a changing channel mix.

This paper will examine these three questions with the goal of helping players in the technology value chain think about and chart their path to change and growth.

What Does the Evolving Managed Services Landscape Look Like?

Becoming a player in today’s Managed Services (MS) landscape starts with a detailed understanding of what that landscape looks like. What are the various types of services a channel partner or VAR could be adding to its offering? Which companies are playing in those spaces? What are competitors doing? If a business is largely offering reactive maintenance and support today, how does they evolve into something more significant—and what does “more significant” look like? Any channel partner or VAR that is moving from a Professional Services- based support model (selling design and installation of hardware and software) to Managed Services must gain a nuanced picture of this arena into which they are moving.

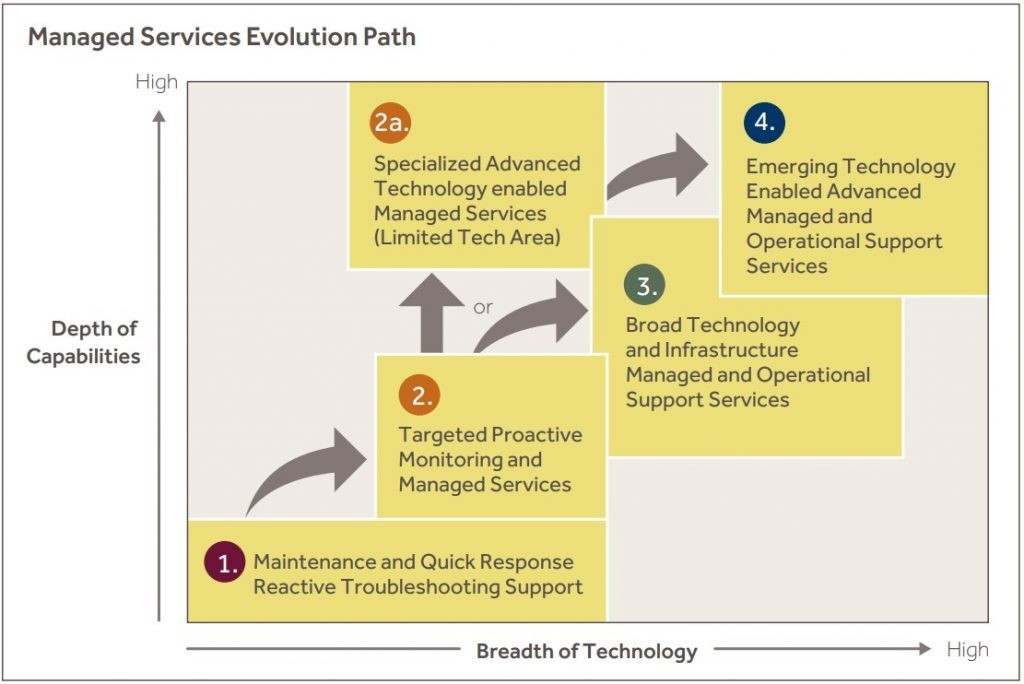

There are four fundamental MS spaces in which companies can play today:

Maintenance and Reactive Troubleshooting. This basic support level provides a “dial for help” lifeline for customers to get basic advice and troubleshooting support from a known and knowledgeable resource. It may be 24/7 but it is all reactive support and many times the support team does not have the latest customer configuration and infrastructure details to rapidly assist. Although better than nothing, it is a very limited and low-value support model.

Proactive Monitoring and Managed Services. This step up from Level 1 provides a significant improvement by leveraging proactive, 24/7 monitoring and management. This support comes from an operational NOC which is constantly monitoring clients’ infrastructure to identify and resolve problems before they cause additional issues or outages. This service relies upon detailed current customer infrastructure information summarized in run books, detailed ITIL or similar processes, specific infrastructure and application monitoring tooling, and problem resolution procedures including activating and managing OEMs or third parties and escalation notifications to the client. Typically, this type of support is initially provided in a limited set of technology areas related to a VAR’s core business (e.g., basic Network Infrastructure [Route/ Switch], UC&C, Data Center/Cloud, or Security). Some VARs follow a specialization path—Level 2A—staying within a limited technology area but driving up capabilities. Good examples include advanced Managed Services in UC&C only (especially advanced Contact Center MS), Data Center MS, Cloud-only provision and MS, and Security-only MS.

Technology and Infrastructure Support Services. The step up to Level 3 provides a Level 2-type

services but across a broad array of technology areas to become a core support element in the client’s infrastructure team. Most clients do not desire to work with multiple MS providers, each covering a specialized area. They look to leverage one, broadly capable support partner to simplify operations and engagement. These offerings will typically cover the full range of infrastructure and application monitoring and support services, including general route/ switch/networking, UC&C, Data Center and Cloud, VDI/DaaS/Desktop/Helpdesk support, and Security (24/7 SOC, SIEM Tool, threat analysis) services. It is important to offer the full range of capabilities, tooling, and support team to execute effectively. This level of VAR Managed Services will typically also provide a broad range of services in a hosted or XaaS mode.

Technology-Enabled Advanced Managed Services. The step up to Level 4 takes the broad and deep capabilities in Level 3 and adds additional analysis and support capabilities by leveraging new emerging technologies in APM, Data Analytics, IoT, Dev Ops, and Advanced Security capabilities. Companies offering these Emerging Technology-enabled Advanced Managed Services become important extensions of a client’s organization, providing deep analysis and development-oriented capabilities to anticipate and better respond to critical situations. These MS partners leverage a range of newer Emerging Technologies as seen in companies like Splunk, AppDynamics/Cisco, Cloudera, Forescout, IXIA, and FireEye.

How Do I Determine Where to Focus?

While the evolutionary path for MS looks clean and logical on paper, it can be overwhelming to consider moving an organization down that path. Where should a company start? How should it determine where to focus its efforts and its limited resources? There are a lot of different ways an organization can go after Managed Services. To determine the best direction for your company, we urge leaders to consider four elements:

- Who are my current customers? Evaluate your current customer base to see where you have strong relationships on which you can build and understand which customers will give you permission to play in the new MS space. It can be helpful to segment customers based on MS needs and develop an evolutionary path to provide Managed Services that meet those needs. This strategy must consider the starting point, customer needs, and investment/ROI.

The starting point might be a company that is providing boxes today and its customers are buying services from someone else. Or their customers may be evolving in the direction of buying services but the company is not at the table because it has not yet understood the ramifications of remaining “boxes only” in a cloud-based world. Ask yourself: “What are the service needs of my customers today and tomorrow?” Make a list. Some of the items on that list may be far afield from your current offerings while some may be close to the core. As you decide where to move, it’s a balancing act. Your direction must be practical, must logical and it must consider where customers will give you permission to play.

- What MS areas are adjacent to my core? If a new MS space is too far afield from a company’s core capabilities, current customers usually won’t move along with that company into the new space. That’s why it makes sense to focus initially on areas adjacent to the core. This expansion of capabilities can happen through acquisition, through adding on skills, or other steps that enable a logical, stepwise progression of capability. Typically, in building out your core capability, close linkage and active dialogue between the Professional Services team and the nucleus of your Managed Services team will be important.

- What existing MS capability can I build on? Take a hard look at where you have the inherent capability today on which you can build. For example, you may have a group that’s very good at providing basic reactive customer support and has naturally started to extend their knowledge into proactive customer support and MS. Build on and formalize that capability.

- What does the business case look like? You know your likely customers, you’ve looked at the MS areas that are close to the core, and you’ve got a core you can build around. Now the question is: Can you sell it? Can the current sales team sell the services? What’s the business model? These new services will require investment—investment in people, tools, in capabilities, and more. Putting together a business plan for the most promising focal areas of the MS landscape can clarify which is the right direction for your company. Typically, the areas with the potential to deliver the highest ROI are the most promising directions for a company to focus its efforts.

How Do I Execute the Move to Managed Services?

Once you decide where to focus, the next step is to create the roadmap that will get you from where you are today to where you want to be on the Managed Services spectrum. Be very clear on the path you are taking—the specific steps that must be developed and launched sequentially to get from Point A to Point B. This isn’t just about service evolution; it also involves an evolution of skill sets, technology, people, organization (i.e., how do I organize around this?), and, importantly, leadership and culture. Firms must have the right leadership in place to guide the transition to MS in a coordinated, well-considered way. One of leadership’s most important roles is to create a new culture of service. In building a world-class MS capability, companies must aggressively build a “Day 2 Support” mindset into the fabric of the company.

As part of the evolution of skill sets, the importance of the sales team cannot be underestimated. Typically, sales reps who are currently selling “boxes” or Maintenance and Reactive Troubleshooting-type services find selling Managed Services very difficult. It is not simply a matter of selling a different product; it’s a different type of sale to a different type of buyer and requires a far different skill set. As companies focus on evolving down the MS path, it is critical that they realign the sales team or leverage overlays to sell MS.

So what does all this look like in practice? Recently we worked with a VAR in the UC&C space that was trying to figure out how to evolve to significantly expand their Managed Services offering. We started by painting a detailed picture of the MS landscape, helping the VAR see its own position in that landscape and its competitors’ positions and offerings. Using the “How do I determine where to focus?” questions as guideposts, we then gained a deep understanding of the VAR’s customer needs and buyer values, both current and future; the ability of the current offering to meet customer needs; where the company had a “right” to play; and the skills/ capabilities of the existing leadership team to evolve to higher levels of Managed Services. With this information and high-level investment parameters in hand, we developed a “To Be” MS model and laid it alongside the current “As Is” structure. The gaps between the two highlighted the key activities required to build out the new managed services and offers.

To close those gaps and evolve its MS services, the company, over an 18-month period, hired new leadership, strengthened and expanded its core team, acquired critical new capabilities, and revamped the sales team to support the MS initiatives. The VAR started the process with 5 or 6 people distributed across different parts of the company and only limited or partial offerings in one OEM UC&C technology area. It evolved to an integrated team led by a new, highly talented leader who drove the build-out of offerings. Those offerings included proactive UC monitoring and problem resolution across voice, video, collaboration, and contact center; UC support services including MACD and asset configuration; and XaaS-hosted UC solutions for video, voice, and contact center. The business experienced strong growth as its capabilities advanced, enabling it to become a significant new player in the Managed Services landscape.

The Blue Ridge Partners approach to working with channel partners on Managed Services

Our work with channel partners on Managed Services is always tailored to the issues at hand. In our approach, we leverage our understanding of the wider value chain and customer needs and requirements, always focusing on key insights and results. There are typically seven aspects to helping channel partners re-tool in this new world:

- Build an external view of the market. Thoroughly understand end-customer values, what they want and need, and how they make purchasing decisions. We actively engage with stakeholders as part of our work.

- Prioritize end-customer segments. Segment end-markets and identify high-value segments. We look at the pace of adoption, and receptiveness to SaaS/XaaS. This results in revenue opportunity and urgency to reach.

- Identify the optimal solution set. Pinpoint the optimal set of MS services, e.g. proactive UC Monitoring, XaaS, UC Support Services as best fits new end-customer values.

- Understand capability gaps. Know what is required to sell and market the right suite of solutions. Gap analysis of capabilities to deliver the new solutions vs. what is in place. Identify missing capabilities and implement them.

- Integrate your current MS services. Bring your offerings all together under one strong leader who can drive the expansion of MS services.

- Revamp the sales model. Adapt the sales model to the changed perspective of customers, the different decision-making dynamics, and the more Managed Service-type of offering.

- Develop GTM strategy. Target high-value customer segments, delivering the optimal set of solutions in collaboration with vendors. We take an active role in the implementation to ensure results.

We have developed significant experience working with key players in the technology value chain. We can help VARs understand the implications of a changing world and drive profitable revenue growth in light of vendor priorities and concerns.