Commercial Insurance Broker Case Study

Restructuring the sales organization, developing a sales playbook, and improving branch management effectiveness allowed the company to leverage its leadership position.

Situation and Challenge

- Through industry consolidation, this large, European independent insurance broker was in a leadership position but was unsure how to capitalize on it

- Blue Ridge Partners was asked to perform an assessment of the broker’s sales organization and identify opportunities to leverage its leadership position and accelerate revenue growth

Approach

- Conducted in-depth assessment of internal brokers including numerous in-person broker field visits

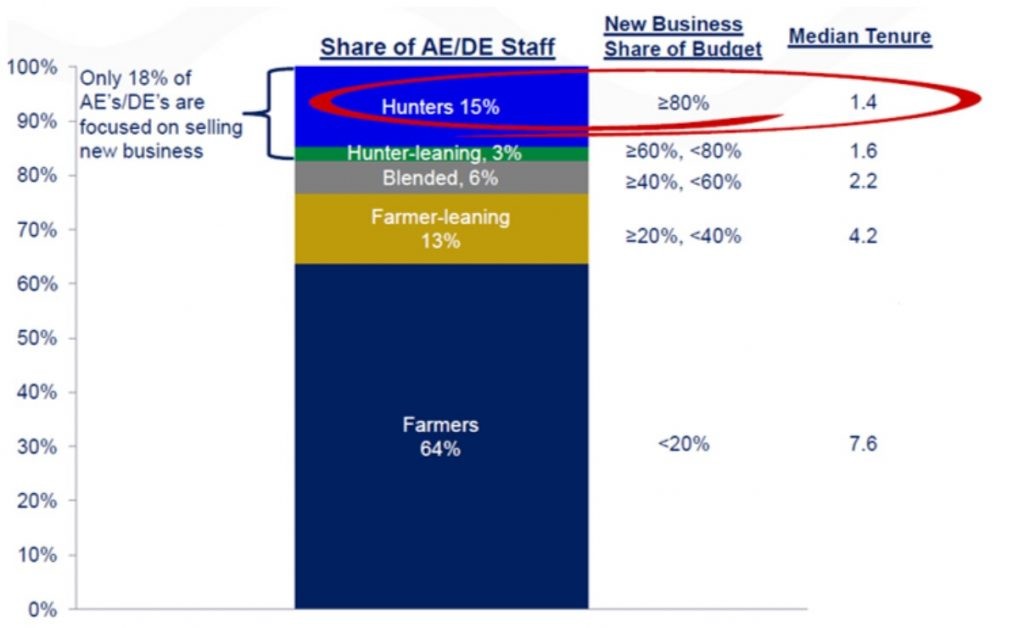

- Performed a Skill/Will analysis of account executives and new business development executives to identify strengths and gaps

- Mapped distribution of hunters versus farmers in the sales force

- Analyzed market penetration rates across sample broker geographies

- Performed account executive and development executive compensation analysis

- Performed The Nine Voices of the Market® interviews to better understand the external market perspective and the client’s current value proposition

- Developed a series of solutions for identified opportunity areas

Impact

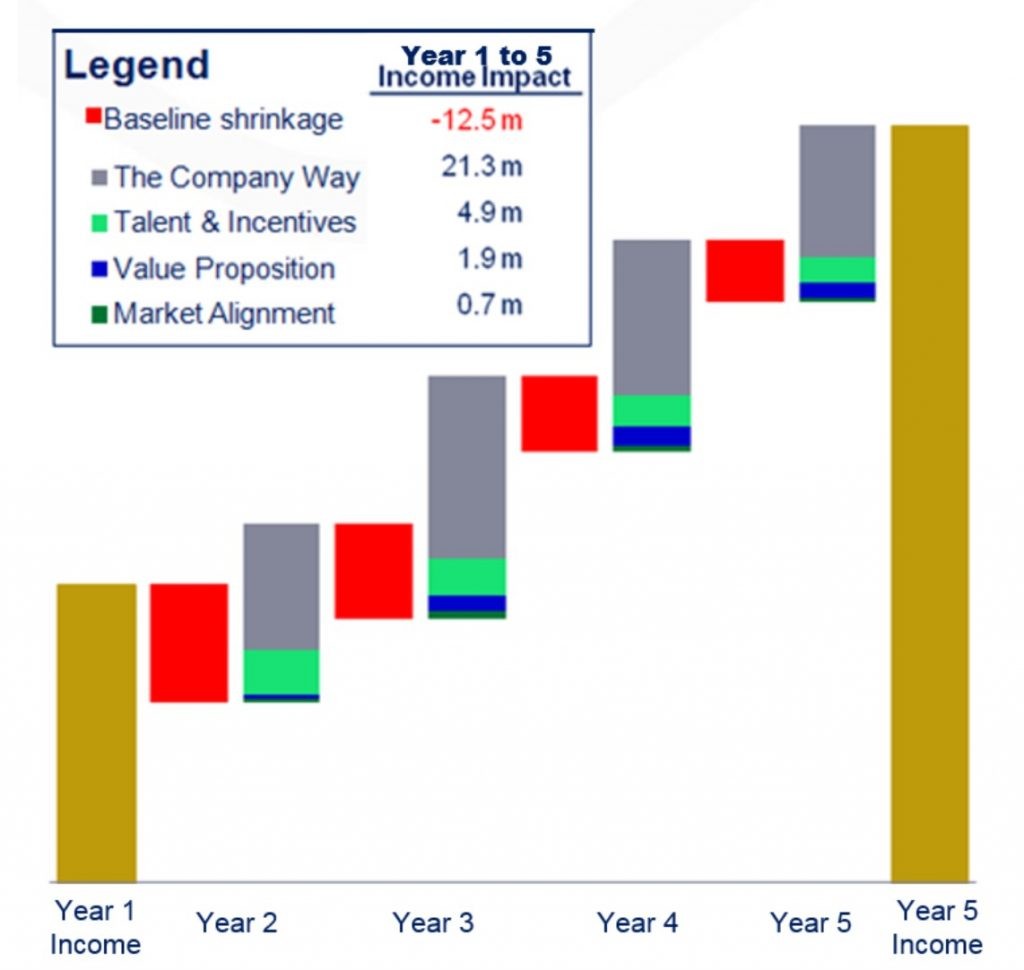

- A new team-based approach and additional resources to support new business development activities led to increased new revenues

- A new standard playbook and tools provide improved branch management effectiveness and enabled management of behaviors in addition to results

- Aligning compensation incentives and bonus structures with business goals provided sufficient incentive for sales reps to drive to the next level

- Coordinated best practices lead generation activities across branches ensured a healthy pipeline of high-quality prospects

- Closing delivery gaps in offering value propositions provided brokers a differentiated service to sell