Industrial Pricing Power in 2025: Overcoming Execution Challenges to Drive Growth

Introduction

As industrial companies finalize their pricing strategies for 2025, one thing is clear: price increases remain a key growth lever. However, execution challenges continue to undermine their success. A recent survey of 100 C-suite executives from U.S. industrial firms, conducted by Blue Ridge Partners, highlights the critical roadblocks companies face in implementing price hikes effectively.

Key Takeaways from 2024 Pricing Trends

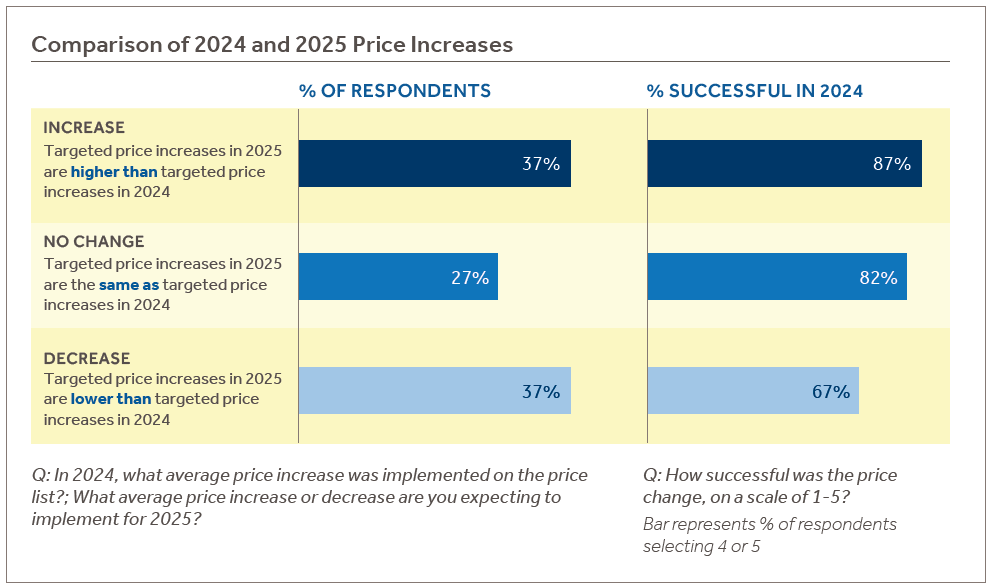

In 2024, 82% of industrial companies increased prices by at least 5%, yet many struggled to fully capture the intended gains. Execution gaps—such as poor customer communication, inadequate sales enablement, and weak price enforcement—led to missed revenue opportunities.

Despite these challenges, pricing remains a top priority in 2025. However, companies are approaching it with more caution, informed by past difficulties and evolving market dynamics.

Price Increases in 2025: Strategic Adjustments

While price increases will continue, firms are adopting more calculated and flexible approaches:

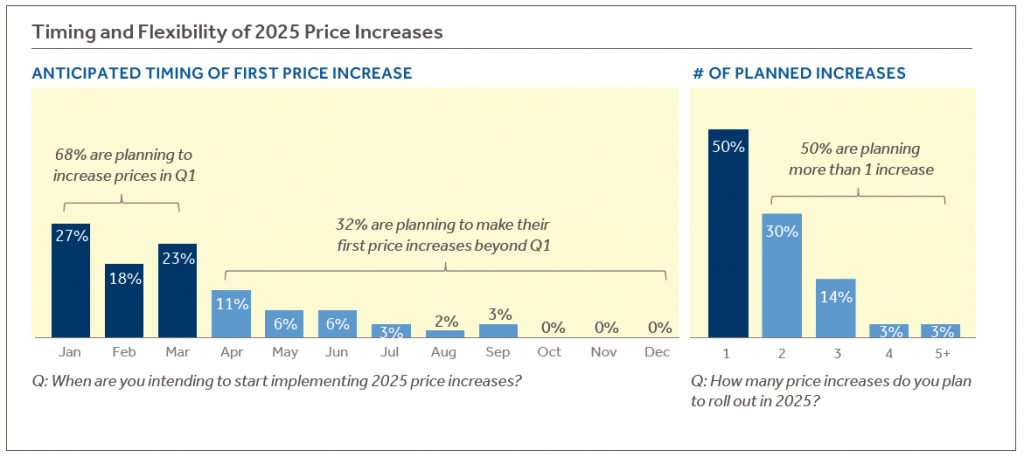

- Early Action Matters: Nearly 70% of companies plan to implement price increases in Q1 to establish momentum.

- Multiple Adjustments: 50% of companies intend to make multiple price adjustments throughout 2025 to remain agile.

- Caution for Underperformers: Companies that failed to achieve their 2024 price increase targets are more likely to set lower targets for 2025.

Timing & Flexibility: A Key Competitive Advantage

Industrial firms that act early while maintaining flexibility will have the strongest pricing position in 2025. Those delaying due to uncertainties—such as potential tariffs—risk falling into a reactive strategy, weakening their pricing power and profitability.

Biggest Execution Challenges & How to Overcome Them

Despite clear pricing strategies, execution remains the biggest hurdle. Nearly 90% of companies failed to fully capture their planned 2024 price increases. The most common pitfalls include:

1. Weak Customer Communication

Many companies struggle to justify price increases to customers, leading to resistance. Solution: Equip sales teams with clear, data-driven explanations tied to industry cost drivers (e.g., raw materials, labor, logistics).

2. Poor Sales Enablement

Procurement teams are highly skilled at resisting price hikes, but many sales teams lack the training to counter objections. Solution: Invest in negotiation training and value-based selling strategies.

3. Lack of Price Tracking & Enforcement

Without real-time visibility, price increases can slip through during contract renewals. Solution: Implement automated tracking tools and governance frameworks to ensure compliance.

Conclusion: A Proactive Approach is Essential

Pricing will remain a critical revenue driver in 2025, but companies that fail to execute properly risk stagnant margins and lost profits. The winners will be those that:

- Strengthen customer messaging

- Train sales teams to handle negotiations effectively

- Implement price tracking tools to prevent revenue leakage

Industrial firms that act now will not only protect margins but also gain a long-term competitive edge.