Driving Customer Engagement through Segmentation

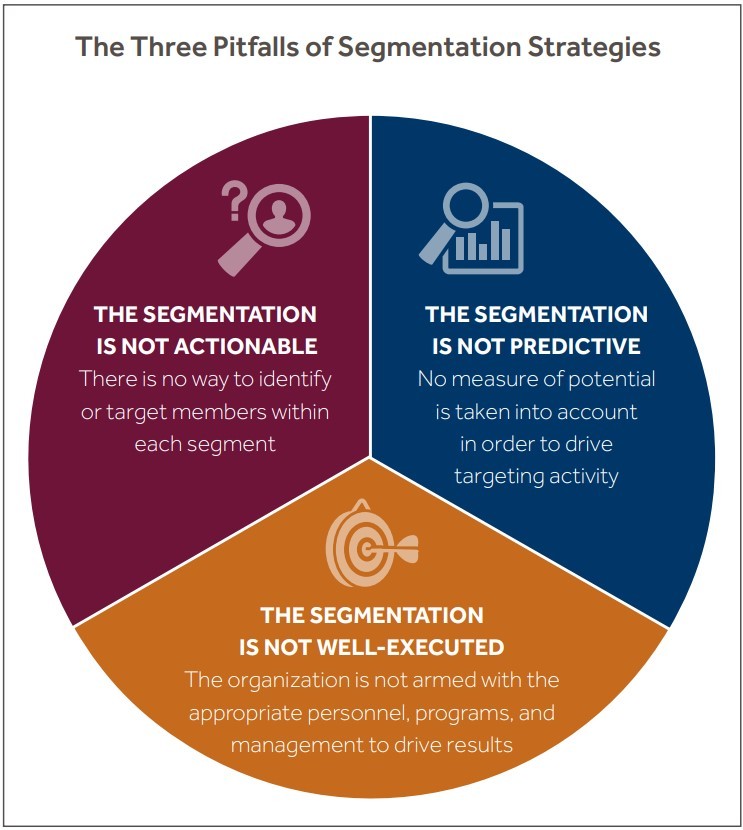

Introduction: The Three Pitfalls

As organizations encounter increasingly competitive markets, shifting buyer values, and rising customer expectations, executives are asking themselves how to develop a customer engagement strategy that maximizes both customer satisfaction and top-line revenues. One tried-and-true solution is to identify differences in customer behavior and values to create distinct segments that can be targeted through tailored programs, messaging, and sales and service support.

Organizations segment their customers in virtually every way imaginable. Whether they take a simplistic approach using basic company characteristics, an attitudes-driven approach relying on a thorough understanding of customer beliefs, or a predictive approach that uses complex algorithms to predict future behavior, we find nearly all segmentation strategies risk failing along one or more of three dimensions:

- The segmentation is not actionable. On the surface, the segmentation creates distinct groups of customers that seem to be meaningfully clustered, but in practice, they are too difficult to target in a unique, relevant way. This often happens when segments are defined using overly vague or broad measures, such as industry or geography.

- The segmentation does not account for potential. Organizations frequently segment customers by looking at the past performance or at current usage and attitudes. This approach, though widespread, reveals only the current value of customers and does not consider their future potential. As a result, companies may prioritize a group of customers who are of high value at the time but have little room to grow over a group with lower immediate value but with significant growth potential.

- The segmentation is not well executed. Even when companies avoid the first two pitfalls, many segmentations fail to achieve the desired results because the organization has not put in place the right processes, resources, or oversight to ensure success. Too often, we have seen good segmentations become “shelfware” because the company did not see the plan through to execution.

Overcoming the Pitfalls to Segmentation

Though these pitfalls may seem intuitive, in practice they are quite difficult to avoid and require significant forethought and meticulous planning to sidestep. The effort pays off, however, as we have seen many clients use a well-designed customer engagement strategy to drive top-line revenue growth increases of up to 10%. In each case, the key to achieving those results was planning ahead to steer clear of the segmentation hazards.

1. Make the Segmentation Actionable

Companies invest in segmenting to better target customers and, ultimately, drive growth. In other words, they intend to take some sort of action with each segment, which means the segment must be actionable. It cannot merely be an elegant academic exercise. The outcome must produce internally homogenous groups whose members are easily identified.

Whether a segmentation is actionable ultimately depends upon two factors: the degree of complexity the organization can absorb and the level of targeting specificity desired. There are inherent trade-offs to be made here. An extremely targeted segmentation may be more effective, but practically impossible to execute in-market. On the other hand, an overly simple segmentation can result in a “shotgun” approach to customer targeting that achieves suboptimal results. How does one strike the right balance?

To answer that question, it is important to consider the segmentation’s intended use. Are you trying to prioritize the activities of your salespeople? Does your marketing team want to develop more targeted campaigns aimed at specific customer types? Are you running complex database marketing programs and looking to improve response rates? Each of these objectives leads to different definitions of what constitutes an actionable segmentation.

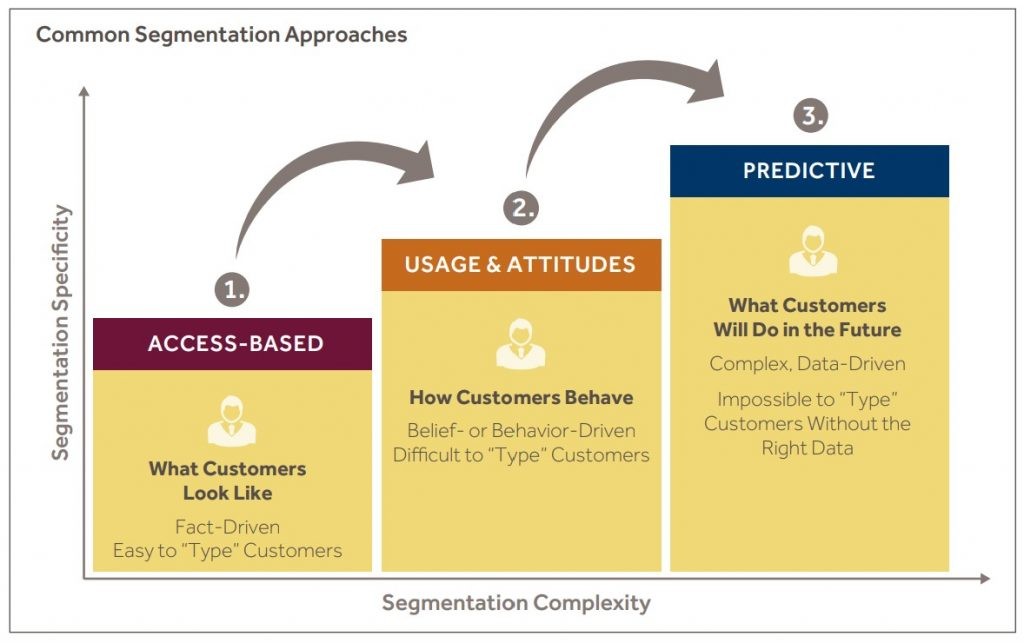

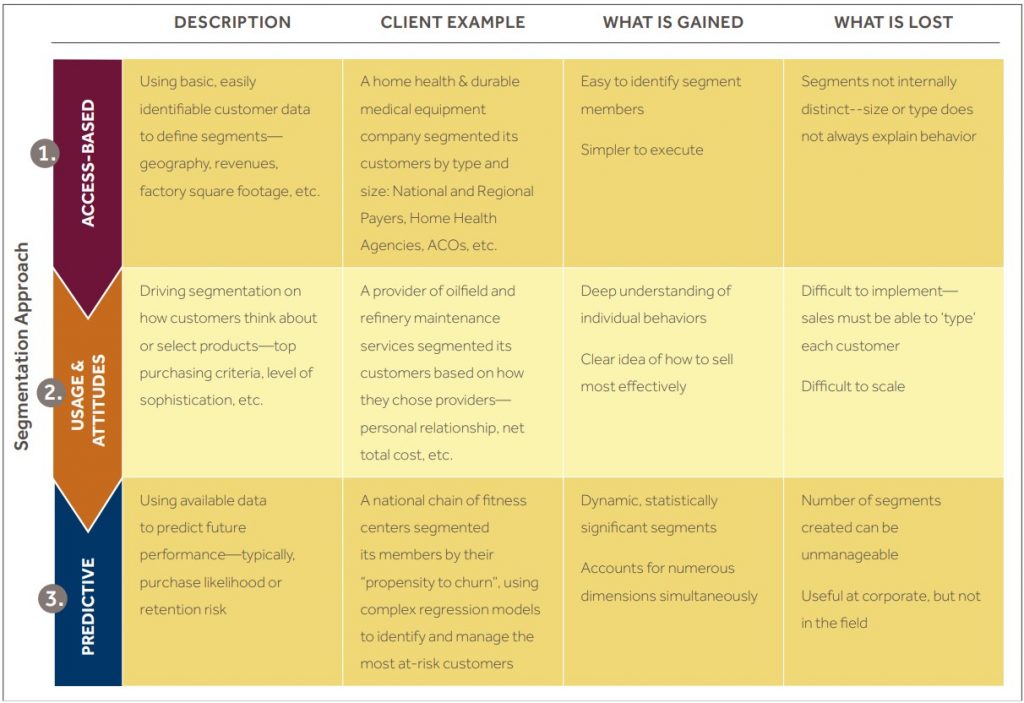

In our experience, clients who have struggled to identify the best segmentation approach have been more successful when they resisted the urge to pursue a perfectly precise solution and instead opted for a simple segmentation that the organization could operationalize. The reason for this is straightforward: good execution trumps perfect segmentation, which can always be refined based on early results. When it comes to designing an actionable segmentation, companies typically use one of three general approaches: access-driven, usage- or attitudes-driven, or predictive (see graphic).

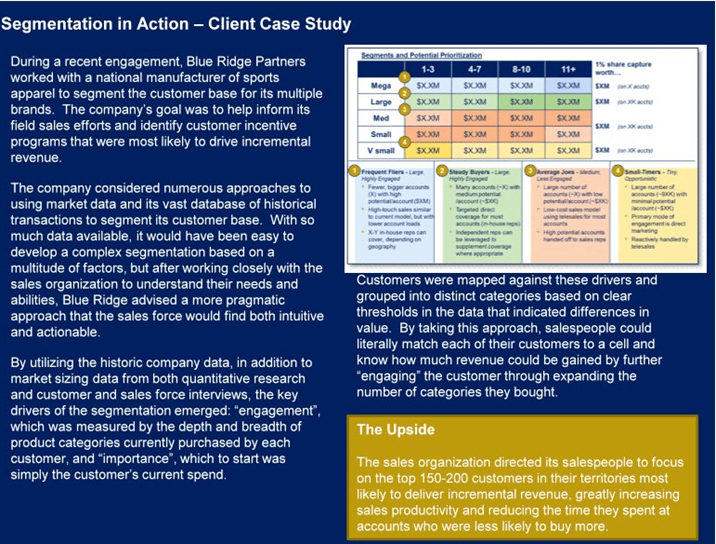

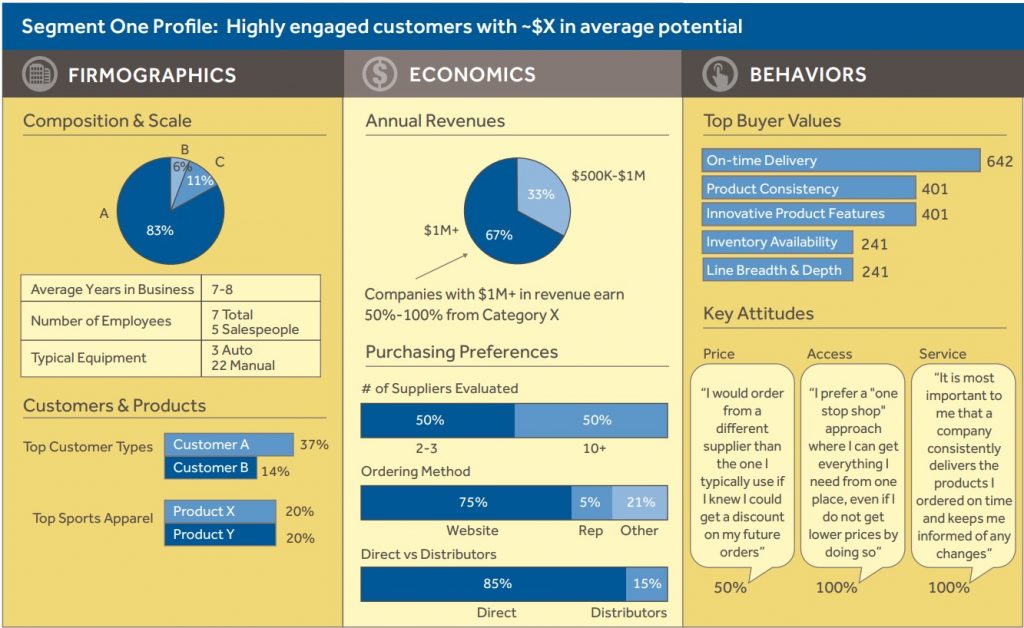

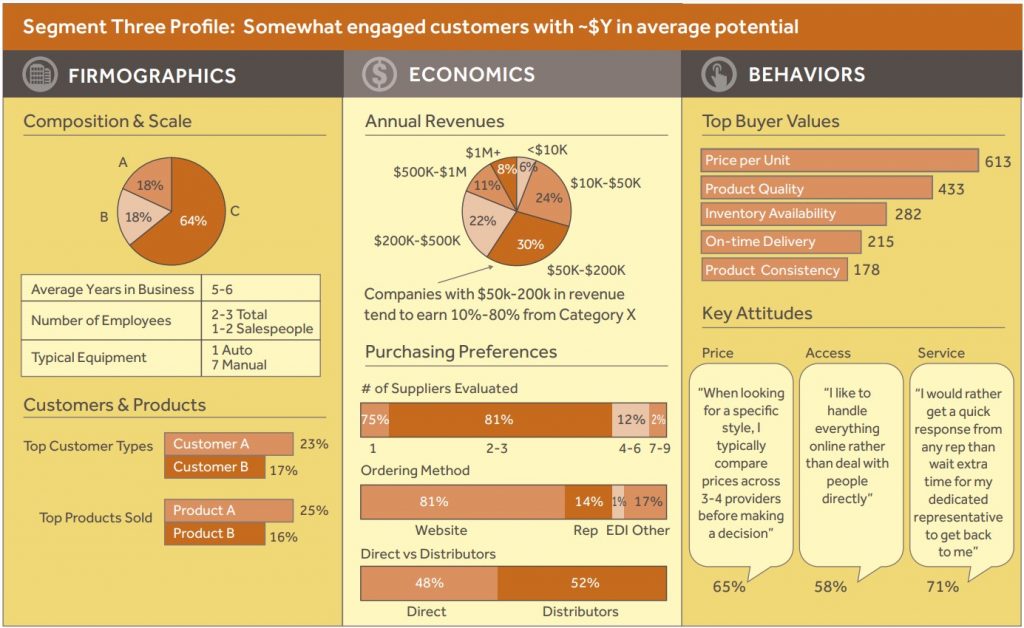

Choosing the best segmentation approach requires both an understanding of the objective/usage and the trade-offs that must be made. If the company’s objective is to help the sales force target higher-value accounts, a basic segmentation using company size and purchase history might be sufficient. However, what the company gains in making sure sales are knocking on the right doors may be lost in the specificity of the message the sales team delivers and the promotional offers marketing creates. For example, when we worked with a national manufacturer of sports apparel to segment its customer base, the company opted to take a usage and attitudes approach. This method enabled the sales team to see exactly how much revenue they could gain by further engagement with each customer so they could better decide where to spend their time. Though the manufacturer sacrificed scalability in selecting this approach, it was an acceptable trade-off for the potential gains in sales rep productivity.

2. Incorporate Potential

In creating segments, companies often fall into the trap of assuming that past or current traits are indicative of future ones. While segmenting customers by current usage or attitudes can be informative, it tends to tell the company which customers are the best match for what the organization already offers; it is less effective in guiding sales and marketing to where they should be going next.

Similarly, segmenting by current spending or product purchasing behavior can be misleading without accounting for potential. Very frequently, sales and marketing prioritize segments that have high value currently but little room to grow. All too often, in-depth analyses of sales activity reveal that the lion’s share of selling time—sometimes up to 80% of it—is being spent on the largest current customers who are already giving the company 75% of eligible spending. That selling time would be much more valuable spent targeting accounts with room to grow.

The solution to this problem is to build a measure of potential value into the segmentation. This measure can be a driver of the segmentation or just a characteristic of the segments, but it must be included in order to make effective prioritization decisions.

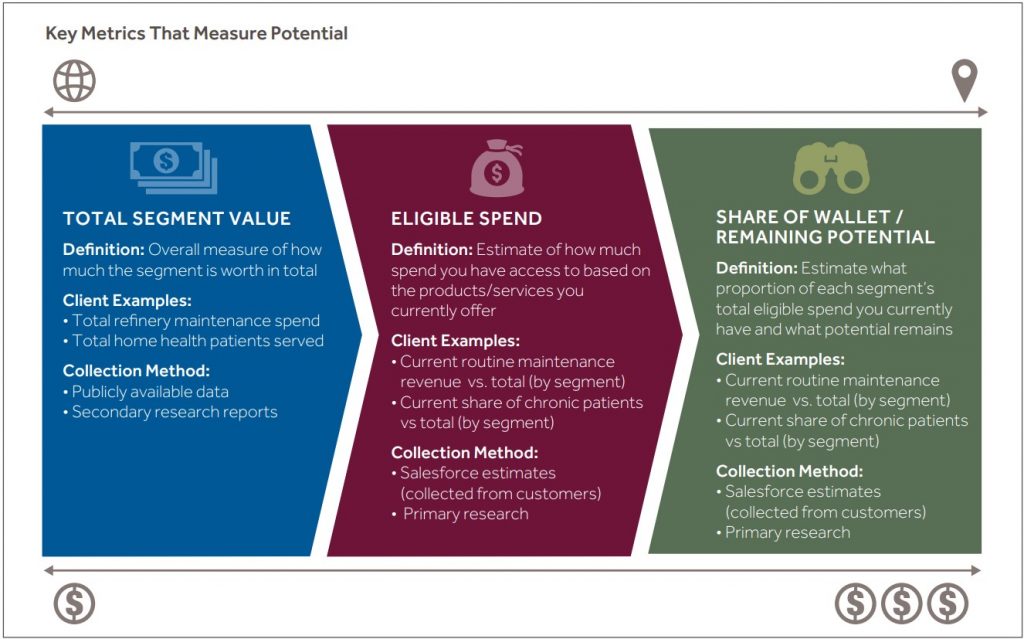

The concept of potential can be elusive for B2B companies. To pin it down, a good first step is to estimate the total value/potential of each segment as this data can sometimes be derived from public or secondary sources. Next, seek to develop a sense of “eligible spend.” Not all potential is addressable, so adjust the opportunity to match the specific set of products/services offered, either currently or in the future. Alongside internal estimates, industry or trade-specific sources can also prove useful. Of course, primary research with target customers is the most desirable source for identifying potential. If time and resources are too scarce to collect this data at scale, a few data points from friendly customers will help triangulate estimates of potential. For most companies, it is usually not feasible to accurately estimate the potential for every customer; however, it is enormously valuable for organizations to provide starting points that sales can use to think about prioritizing their segments and accounts. One of our clients was able to do this at the segment level by asking its customers two basic questions about total revenue and revenue from product categories sold by our client.

Using a combination of anonymous survey results from accounts in their database and phone interviews with a random sample of customers, the company was able to garner enough data points in each segment to estimate total and eligible spending. Most importantly, the organization could link those responses to actual spending and estimate their wallet share for each segment. The sales organization used this data to prioritize their efforts and, as specific customers were engaged, provided data back to the company that allowed wallet share estimates to be further refined.

As this example illustrates, incorporating potential into the segmentation equation means that sales and marketing teams avoid pouring resources into customers who are near or have reached their revenue limit.

3. Execute Seamlessly

Even when companies avoid the first two pitfalls by creating segments that are actionable and include estimates of potential, acting on the segmentation remains a significant hurdle. Too often, we see good segmentations become “shelfware” because a company did not begin to think about execution early enough in the process. In our experience, successfully implementing a customer engagement strategy is rooted in four principles:

- Align the Organization. Building basic consensus on the segmentation and momentum around using it starts with senior executives. Is it critical for leaders to signal that changes in the way the organization engages its customers are here to stay? If C-level stakeholders and sales executives were not intimately involved in developing the segmentation, their input must be incorporated prior to executing so they are invested in its outcome and are willing to hold others accountable.

- Communicate and Educate. As with any change management initiative, it is vital to have a communication plan that moves internal audiences along the path to full engagement; people need to understand and accept the segmentation before they can bring it to life. Customer-facing roles such as sales, marketing, and customer service are by far the most critical audiences. Having ambassadors within these groups is invaluable. Many companies have used a “train the trainer” model where regional sales managers or high-performing reps become experts in the segmentation and deliver company-developed training modules to their colleagues. This approach serves a dual purpose by creating buy-in among those who will lead the execution while bringing the rest of the organization along with them.

- Provide Activation Tools. Any efforts to institutionalize a segmentation will be ineffective without segment-specific collateral that supports the rollout. Detailed segment profiles (see graphic) should be available in a handbook that describes the segment members, highlights their key values, and provides specific guidance on how to win with each segment (key competitive set, messages that resonate, lead products, etc.). Where appropriate, a “typing tool” should also be made available so that Sales can categorize its customers for targeting purposes. A best practice is to codify all of these components as part of an overall sales playbook that helps the sales force be more company-directed and less self-directed. These materials can also be repurposed for use by media agencies, channel partners, and other external stakeholders.

- Build Measurement Mechanisms. To understand how each segment is performing, it is important to create a targeted set of metrics and measure each segment against those metrics. These metrics generally fall into two groups:

a. Membership metrics. Descriptive variables in CRM or Business intelligence systems that assign customers to segments for tracking and reporting purposes. These fields can be calculated based on the segmentation drivers or hard-coded after performing initial analyses.

b. Performance metrics. Outcome metrics that measure segment-specific performance to gauge how well the organization is executing the customer engagement strategy. Basic measures such as year-over-year revenue growth or increase/decrease in the share of wallet are sufficient as long as they link to the actual drivers of the segmentation and can be analyzed at the segment level.

Updating the Segmentation

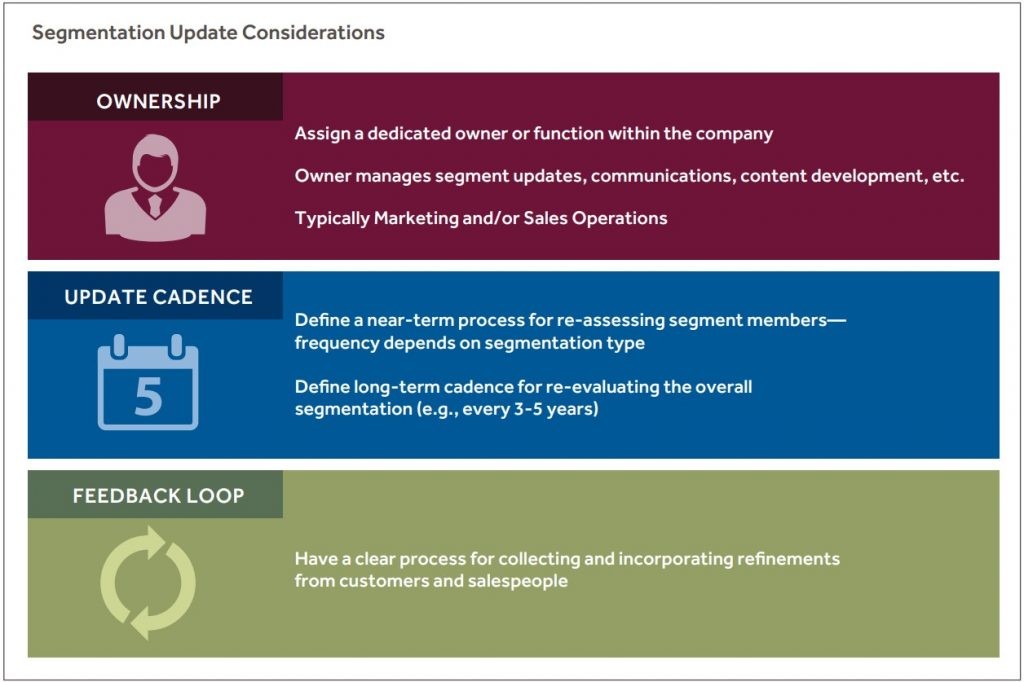

Segmentations that are actionable and predictive are generally not static in nature. As customers change their behavior and become more or less valuable to the organization, their segment membership may change. As a result, organizations need a defined process to manage segmentation on an ongoing basis so it does not become outdated. The three most important aspects of this process include:

- Ownership. Although many groups will use segmentation, a single function must be responsible for managing it. Typically, marketing will own the segmentation since it also owns most programs and communications aimed at driving the segment growth. Assuming that marketing also owns or is involved with customer research and agency management, it is also the right group to communicate updates to the methodology or inputs. For more dynamic segmentations where customer segment assignments depend on readily available sales data, Sales Operations will play a critical role in making sure that the segmentation is accurate.

- Update Cadence. Segmentation accuracy requires near-term and long-term evaluations. In the near term, the variables used for the initial segmentation should be evaluated to determine how often they undergo significant changes that would affect segment membership. For example, if sales results show that an annual realignment is needed, the segmentation would be re-assessed at year-end to determine whether any customers belong in different segments. This is most relevant when segments are based on customer size, purchasing behavior, or potential. In the long term, the segmentation should be periodically evaluated to validate its alignment with the market as shifts in purchasing behavior, regulatory changes, technology innovations, and other market factors can significantly alter underlying behaviors. This level of assessment should be undertaken every 3-5 years using a “research-light” approach that collects data from customers and from the sales force.

- Feedback Loop. An understanding of segments and the customers within those segments almost always becomes more refined and nuanced over time. Organizations should therefore have a process in place for channeling new insights to the internal owners of the segmentation. The type of feedback gathered can range from specific adjustments to a customer profile (i.e., sales discovers that the company’s share of wallet with an account is actually 50% rather than 10%) to larger refinements in how the company understands a particular belief within a segment (e.g., a segment does not view “price” as merely the price per item, but takes into account the total cost of the item including shipping, volume discounts, etc.). Segmentation owners must then have a way to incorporate insights and changes, where warranted, as they arise. For instance, it should be possible to reassign a customer to a different segment outside of the annual reevaluation cycle using a defined exception process.

Taken together, observing these principles will ensure that the segmentation remains in lockstep with market realities.

The Impact of Effective Segmentation

While designing and executing a segmentation gives organizations a better understanding of customers and an improved sense of prioritization, the ultimate goal of segmentation is to drive growth. By improving customer engagement through segmentation-driven activities, we have seen companies grow top-line revenues by 5%-10%. This improvement typically comes from a mix of better penetrating segments where the company is historically strong and adding or growing customers in segments that fall outside of the company’s “sweet spot” and was not well addressed through prior sales, marketing, and product development activities.

Beyond revenue growth, customer segmentation strategies frequently reveal opportunities to drive growth more effectively. Common issue organizations discover is that their highest-cost sales roles are not aligned with their highest-value segments. This misalignment means that field sales are spending too much time calling on small customers with limited potential or calling on large customers who have already maximized their spending with the company. Re-directing field sales to pursue high-potential, high-value segments leads to significant growth and, despite the concerns expressed by many sales reps, typically does not lead to precipitous revenue declines among a company’s largest customers. Another growth opportunity that commonly arises out of client segmentation efforts includes marketing executives learning that their demand generation campaigns have been communicating the wrong messages or have articulated important buyer values in the wrong way. Similarly, product development leaders often discover that although they were effectively serving the needs of current customers, they were not expanding market access by creating new offerings in high-growth or innovative categories valued by under-penetrated segments and prospects.

Segmentation is not just about dividing customers into groups. It is about crafting a customer engagement strategy that articulates pathways to growth and ensures that the organization focuses on the right customers, offers them the right products, and says the right things. Companies that do this effectively stand to increase their share of wallet, improve retention of high-value accounts, acquire new customers, and maximize their return on sales and marketing investments. Those that don’t undertake this effort or that stumble into one of the three pitfalls risk having their sales pitches drowned out by the more targeted and relevant communications from organizations with effective customer engagement strategies.