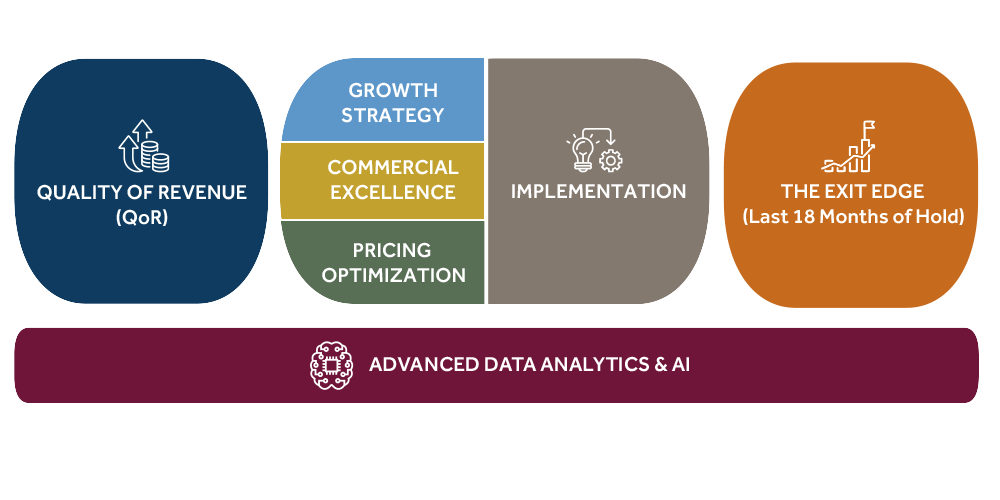

Quality of Revenue (QoR) Diligence

Blue Ridge Partners offers Quality of Revenue Diligence, a fact-based forecast of a company’s revenue performance.

-

Greater conviction in bidding

-

Faster start to organic growth acceleration

-

Mitigation of downside surprises

-

Earlier successful exits

The most proactive and exit-focused PE firms prioritize growth early. They evaluate a target’s QoR alongside its QoE and market context.

Revenue Growth Strategy

Using our proprietary methodologies, we help clients define their revenue growth strategy, including strategic actions and tactical improvements in execution.

- Adjacency Scans

- Market Assessment

- Competitor Position Analysis

- Internal Capability Assessment

- Opportunities to Play and Opportunities to Win

- Growth Plans Inside and Outside the Core

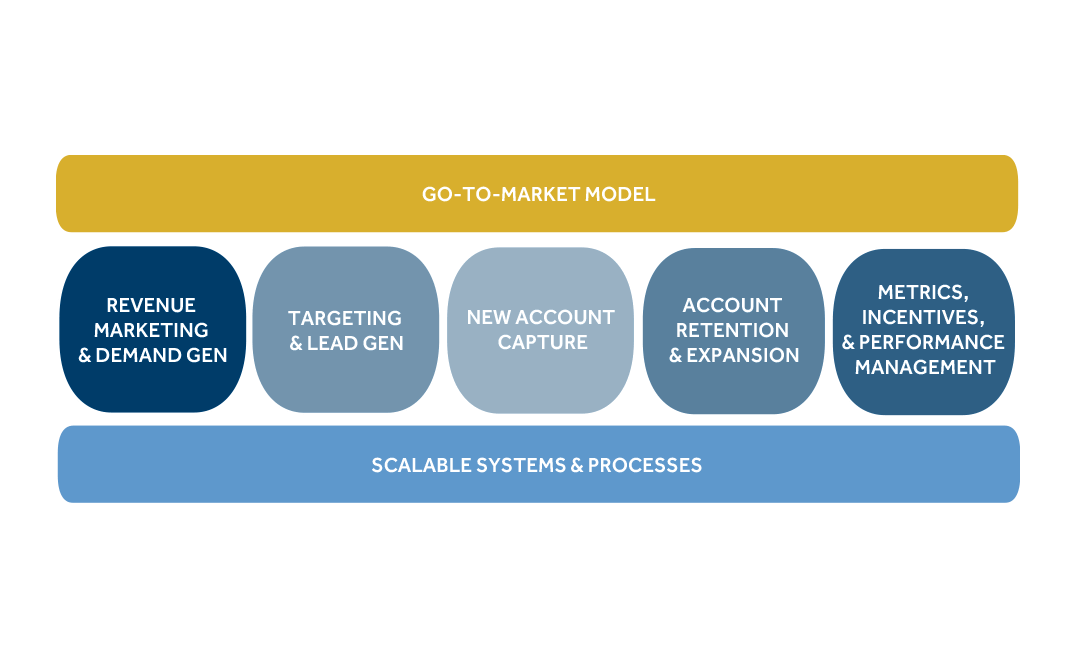

Commercial Effectiveness

Growth requires strong and reliable execution across an organization’s functions: sales, marketing, and customer service.

- Go-to-market model

- Talent, motivation, and culture

- Sales processes and tools

- Field marketing

- Sales enablement and operation

- Sales management

Pricing Optimization

Pricing is one of the most impactful profit levers a company can pull. Our clients often achieve 300 to 600 basis points or more of margin improvement.

Our pricing team tackles three key questions:

- How do you identify the right price?

- How do you ensure customers pay that price?

- How do you sustain and improve pricing performance?

Exit Preparation

Preparing for a successful exit starts early and requires strategic focus. Blue Ridge Partners offers The Exit Edge – Pricing, a high-impact, low-burden exit-focused pricing initiative that surfaces credible pricing upside and tells a fact-based, market-focused growth story. The Exit Edge – Pricing, provides:

- Higher exit valuations through market-validated, underwritable pricing upside

- Stronger buyer confidence with a third-party backed narrative and fact base

- Better prepared management teams who can articulate the pricing story during buyer discussions with conviction

- Faster diligence processes by addressing upside with proof-points buyers can trust

- Reduced risk of value erosion by avoiding blunt pricing actions near the end of the hold period

By taking a disciplined, buyer-focused approach, we help position your company for a high-value exit that captures its true potential.

Commercial AI Strategy & Implementation

At Blue Ridge Partners, we see AI not as a standalone tool but as a strategic enabler of smarter execution and faster growth.

Our team tackles five key questions:

- Where can AI and data drive growth and efficiency?

- What is the potential impact of Commercial AI—and what’s needed to realize it?

- Do we have the right tools, processes, architecture, and team in place?

- Is our data ready for AI and commercial decision-making?

- How do we turn AI insights into measurable performance gains?